Kwsp Table Contribution 2018

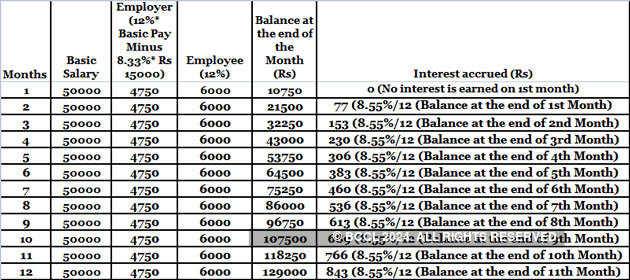

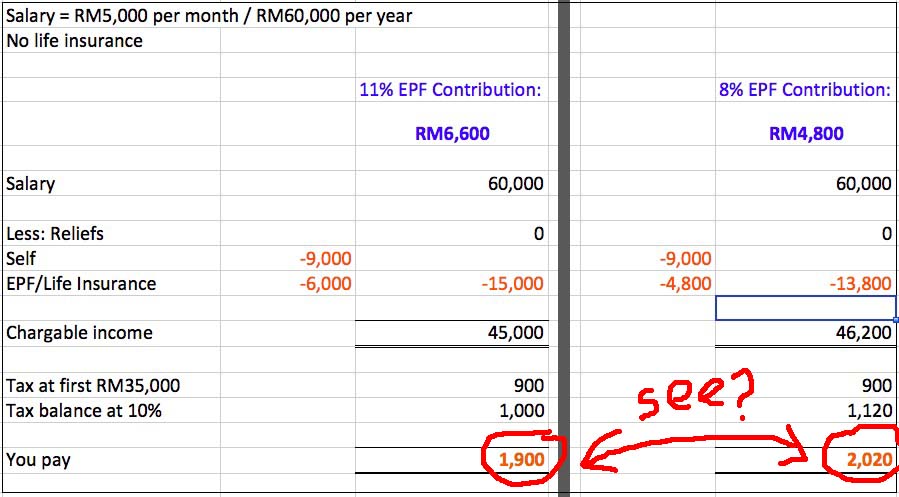

For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

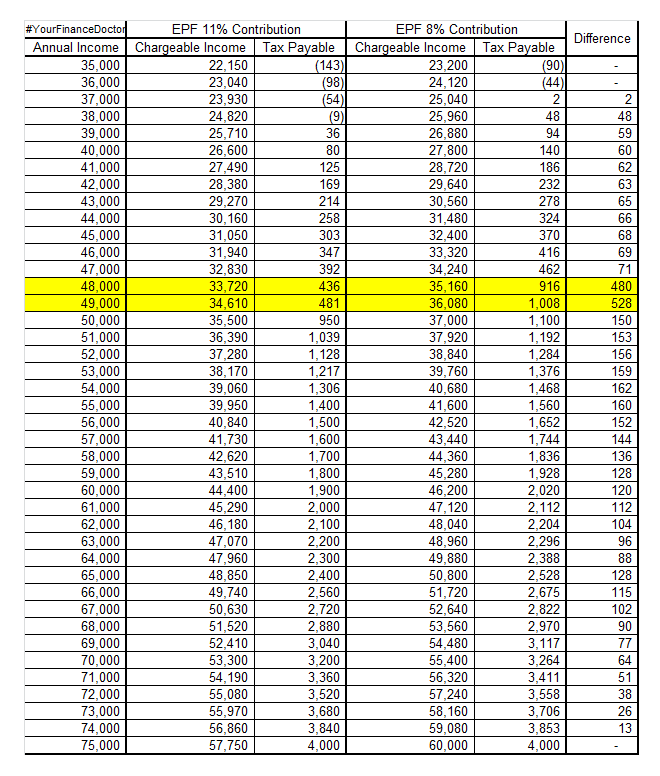

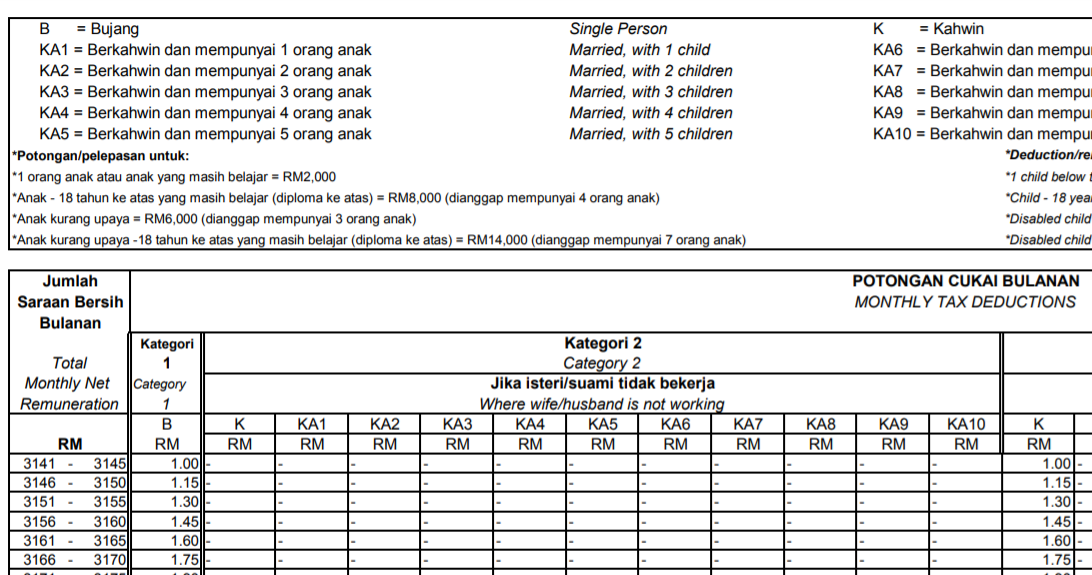

Kwsp table contribution 2018. Third schedule subsection 43 1 rate of monthly contribution part a the rate of monthly contribution specified in this part shall apply to a. Therefore the contribution month is february 2018 and it has to be paid either before or on 15 february 2018. The employees provident fund act 1991 is amended by substituting for the third schedule the following schedule. 12 is also deducting from employer out of which 3 66 is going to your epf account and then remaining 8 33 in your eps employee pension scheme account with a limit of max rs 1250.

Employer must make monthly payment on or before 15th of the month. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60 and from 4 to 5 5 for those aged 60 and above. Kwsp epf contribution rates. Amendment of third schedule 2.

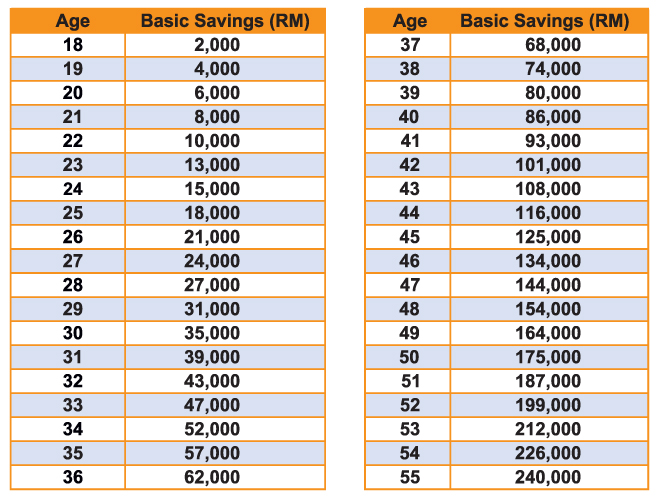

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the contribution rate third schedule monthly contributions are made up of the employee s and employer s share which is paid by the employer through various methods available to them. The employer needs to pay both the employees and the employer s share to the epf. Failing to submit within the stipulated period will result in a late penalty charged by kwsp. The optional rate s will be reset to 11 or 5 5 for employees above age 60 with effective from 1 jan 2018 wages.

2 malaysian government encourages the employer to contribute more than the statutory requirement where any extra contributions is tax deductible up to 19 of the employee s pay. Employers are required to remit epf contributions based on this schedule. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. Info maintenance to epf online services on 12 september 2020 saturday 07 sep info extension of september december 2020 contribution payment date.

The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector.