Kwsp Withdrawal Age 55

About age 55 withdrawal.

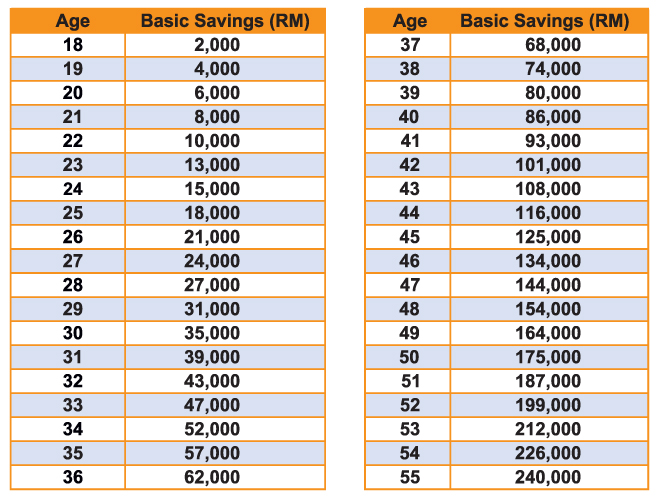

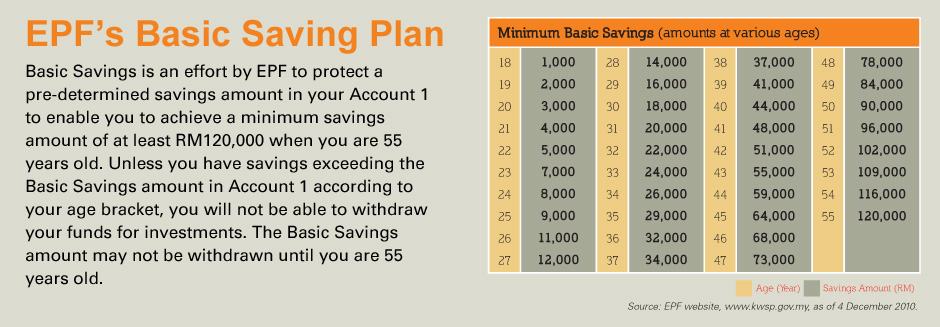

Kwsp withdrawal age 55. There is no change to the current age 55 withdrawal. The employees provident fund epf takes note of the world bank s suggestion to gradually raise the age when members can make full withdrawal of accounts 1 and 2 of their epf retirement savings from 55 to 65. You can withdraw all or part of the savings from this account at any time. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies.

Hence you will have the option to withdraw a lump sum of up to 10 of the savings in your retirement account from age. You have the option to withdraw epf savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. This includes the first 5 000 you can withdraw from age 55 p p for members who turned age 55 in 2012 i e. Health withdrawal to lessen the burden of treatment costs for couples who want to undergo fertility treatment.

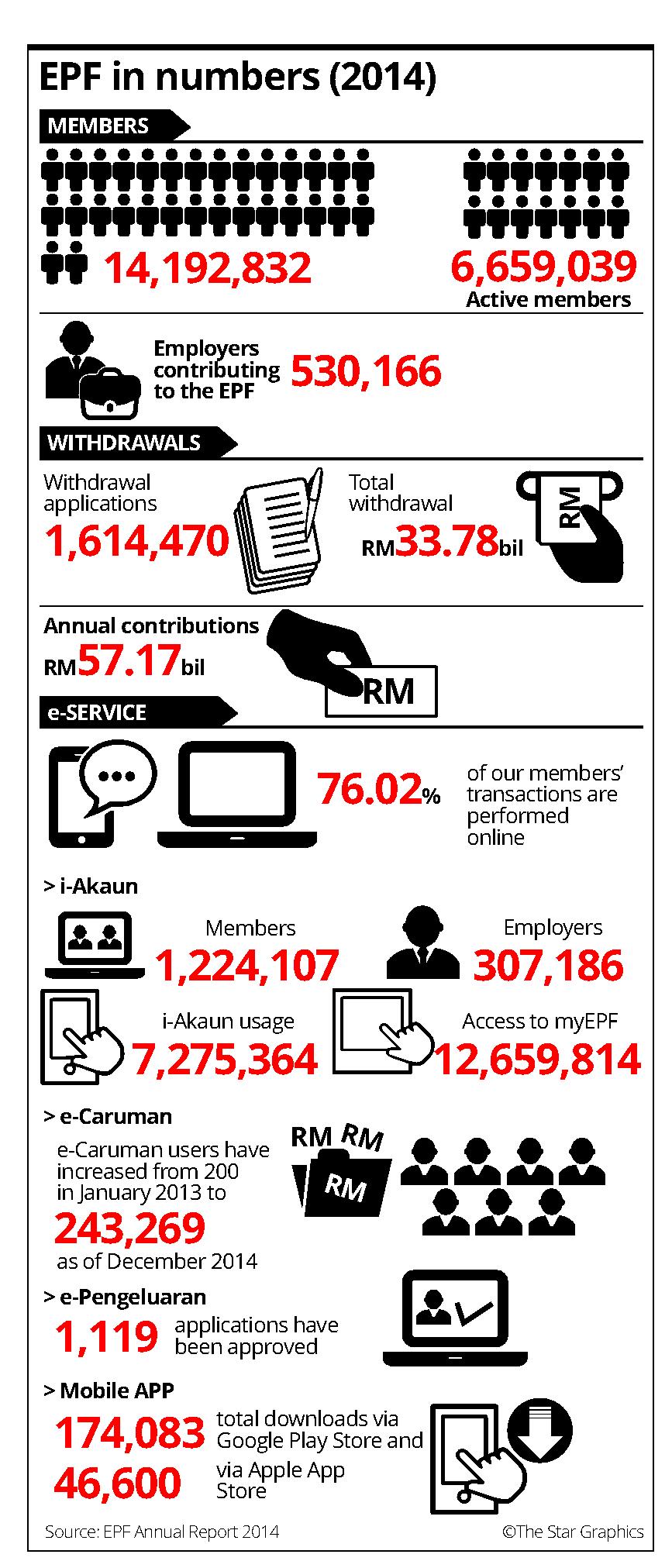

Withdrawal from both account 55 and. Withdraw via i akaun plan ahead for your retirement. The akaun emas is one of the initiatives under the enhancement to the epf schemes as set out under the epf act 1991 where all new contributions received after age 55 will be automatically parked under akaun emas and can only be withdrawn when members reach age 60. You can make a one time withdrawal of all or part of your savings in epf account 2 when you reach age 50.

Full withdrawal at age 55 remains 23 jun info additional fmi platforms connected to epf s i invest 18. Second finance minister datuk seri ahmad husni hanadzlah said private sector workers could still withdraw their full epf savings at age 55. Should you choose to continue working after the age of 55 all further contributions you make will be credited in your akaun emas to be withdrawn only upon reaching age 60. This is the most common form of epf withdrawal.

When you reach a certain age the epf allows you to withdraw partially or in full the savings in account 2. Have savings in account 2. Aged between 50 and before reaching the age of 55. For former malaysian citizens that were epf.

What you can withdraw. Entire savings in account 2. Born in 1957 you can already withdraw up to 10 of your special account and ordinary account savings from age 55. Withdrawal from akaun 55.

The employees provident fund epf has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next january. Upon reaching age 55 the contributions made to your account 1 and account 2 will be consolidated into account 55.