Kwsp Withdrawal For House Loan Installment

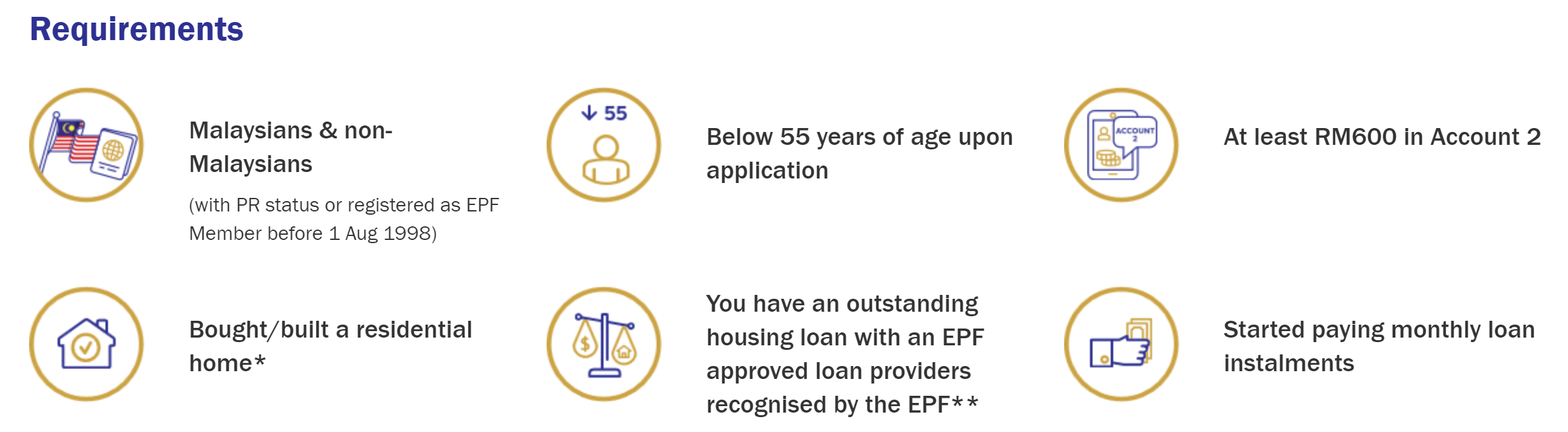

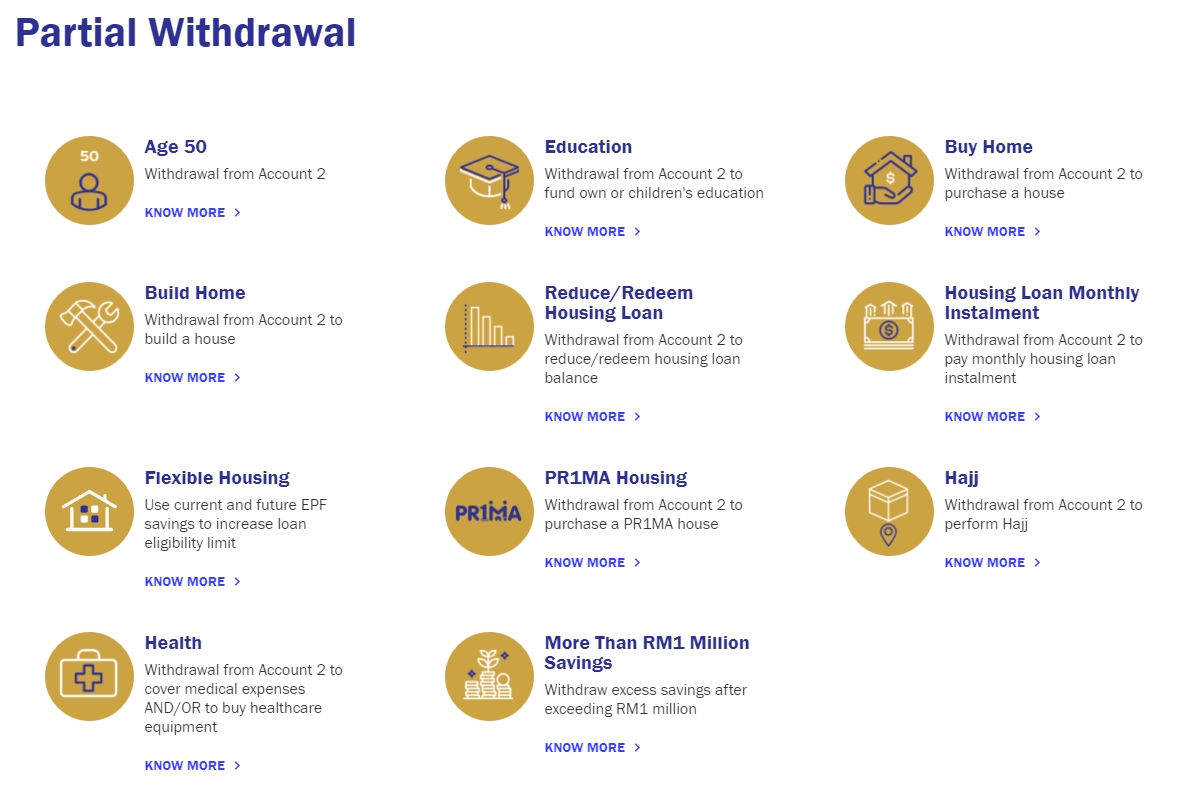

For most malaysians there are several types of epf withdrawals to highlight.

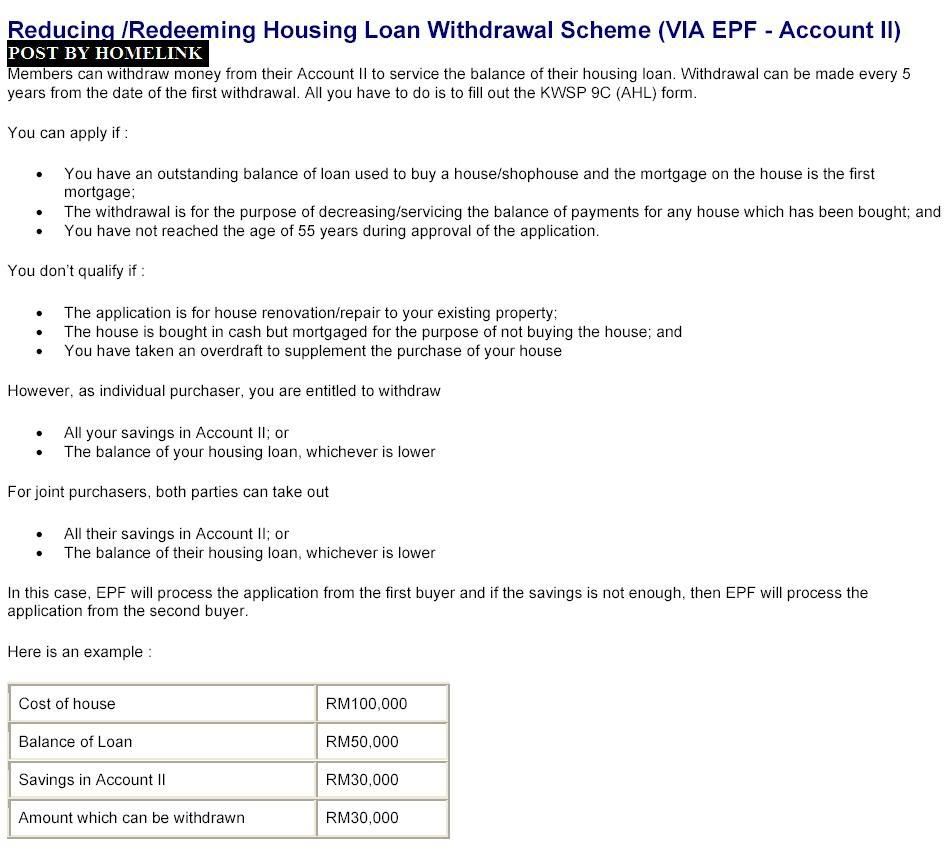

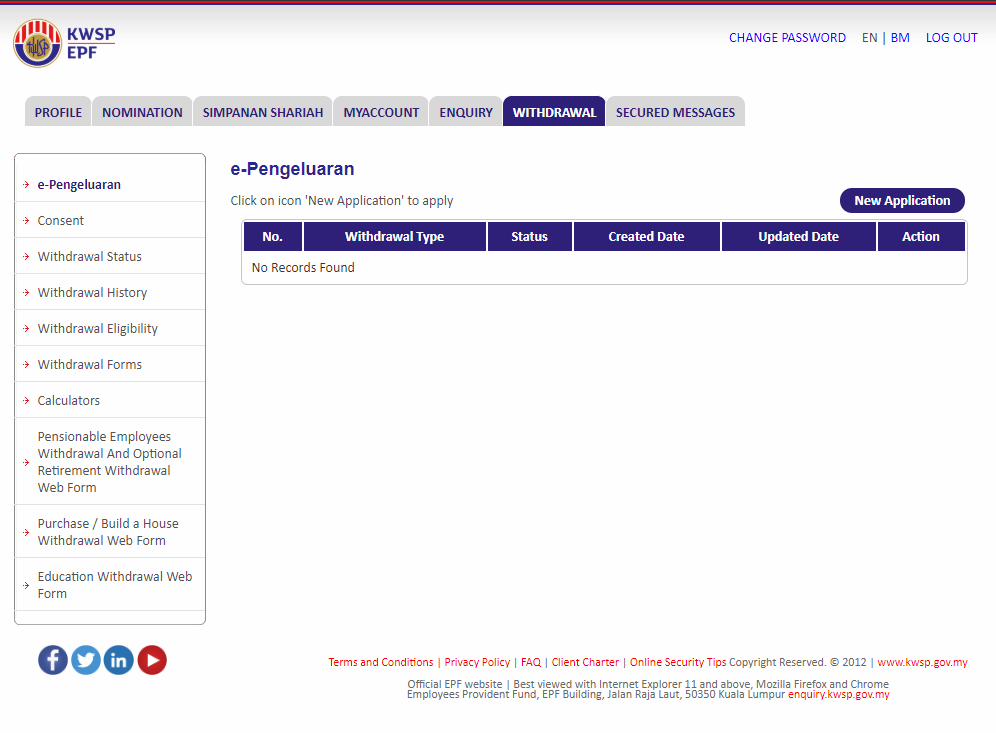

Kwsp withdrawal for house loan installment. I went to the epf office the following tuesday to submit my application along with the statement from the bank. Settling existing home loans. Fyi i have used my epf account 2 withdrawal twice to pay for my first second house deposit i thought that i am not able to withdraw anymore but with the discovery of kwsp housing loan monthly installment i am able to utilize my epf account 2 to pay off my monthly installment pay extra rm2000 from my existing allocation. Loan in the.

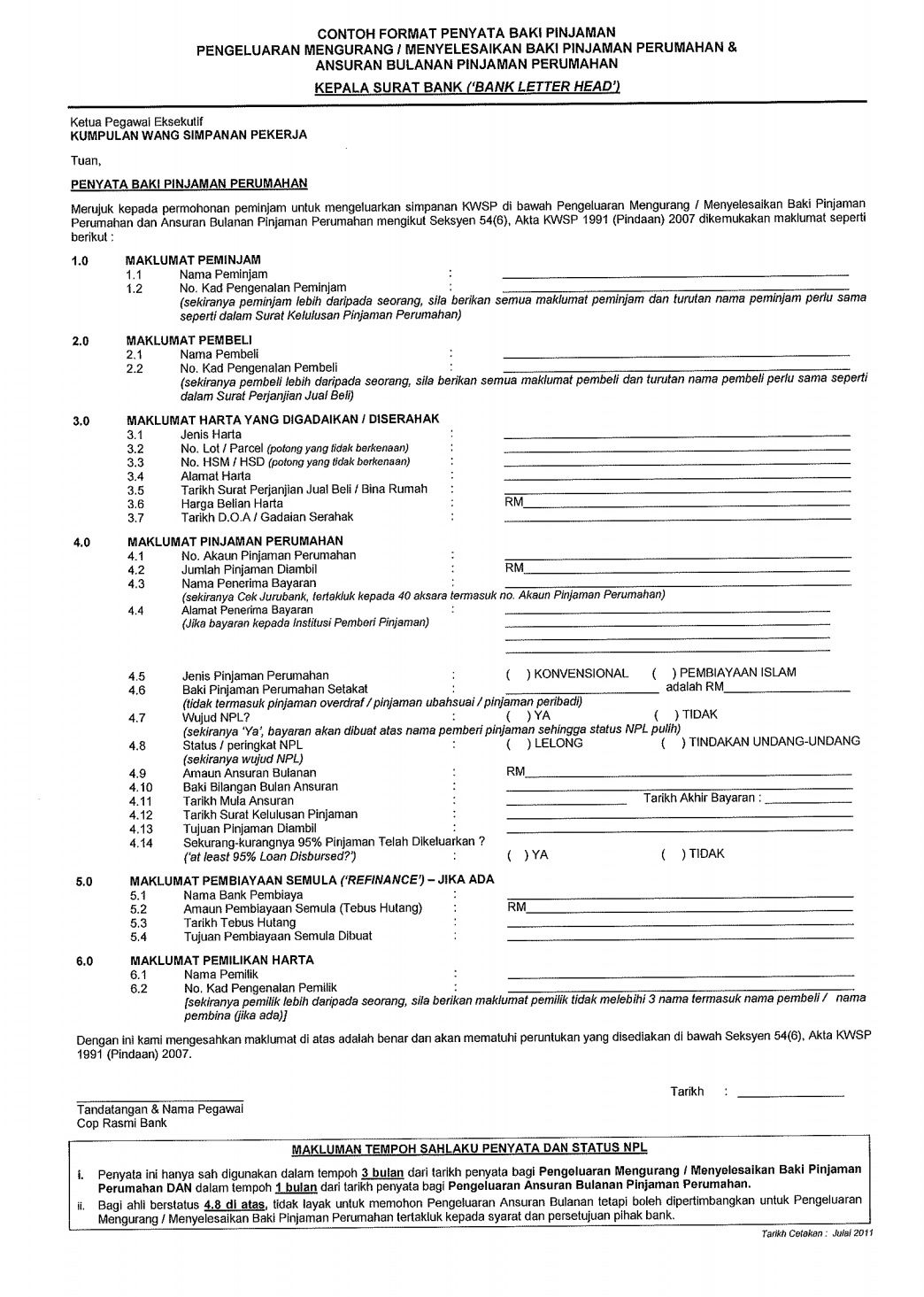

They requested for my ic account number that i want my epf money to be transferred to. This type of withdrawal involves you withdrawing money from your account 2 to finance your monthly installments for your housing loan which was taken up either to buy a new house or build a new one. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. There sure is a lot of reasons the epf allows you to withdraw simply because the situations above regularly requires a large sum of money upfront.

For the purpose of repaying the outstanding home loan the pf member is allowed to withdraw up to 90 of the corpus if the house is registered in his or her name or held jointly however to withdraw the amount at least 3 years of complete service is required. The purpose of the loan is to renovate repair or to carry out additional works to the existing house or for personal purposes. Withdrawal limits money from epf account 2 can be used to pay the price difference between the spa house price and the housing loan amount up to an additional 10 on the price of the house. Those with npl status can apply for withdrawal the payment will be paid straight into the housing loan account.

Monthly instalment payments should not exceed 55 years of age. If member has made prior withdrawal s to buy or build a house member may only make withdrawal for the same house or to assist member s spouse for a different house. Circumstances and conditions for the maximum amount allowed but the withdrawal guideline is either 10 of the house price or all of account 2. To qualify you would need to provide the sale and purchase agreement which is not more than 3 years from the date of application among other related documents as listed in epf s website.

Member is not eligible to apply if. At the counter they asked whether i want to deduct my loan principal or monthly installment. I personally chose to deduct my monthly installment. This is the most common form of epf withdrawal.