Kwsp Withdrawal For House

This withdrawal allows you to buy a house from a developer or.

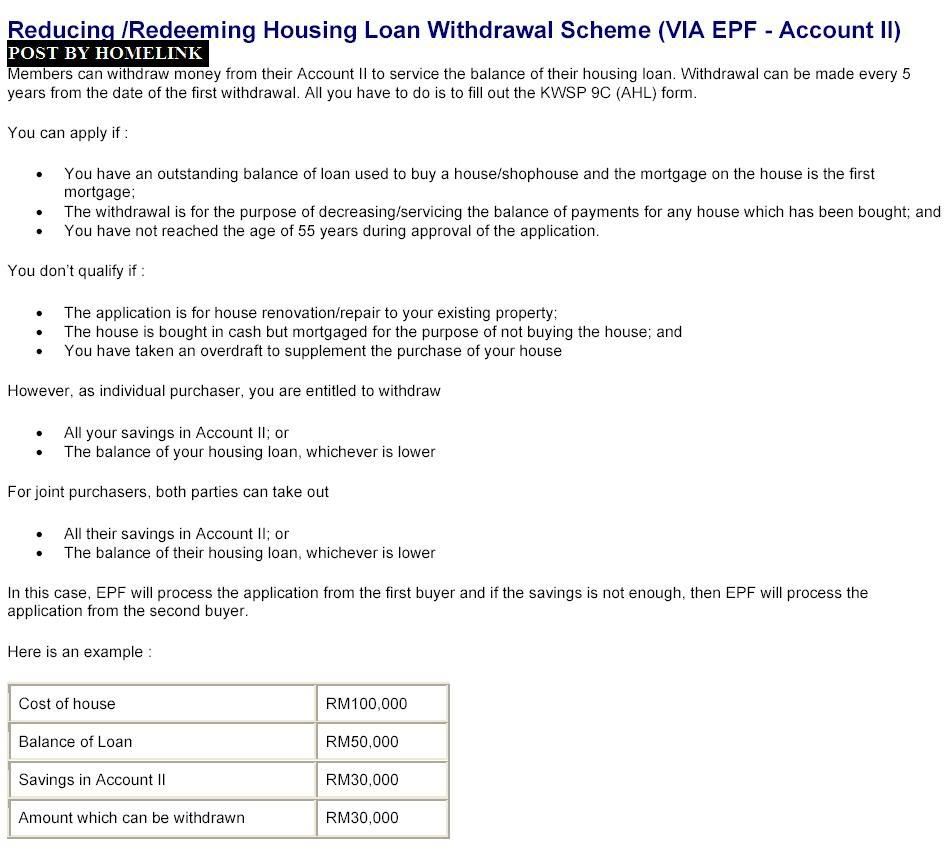

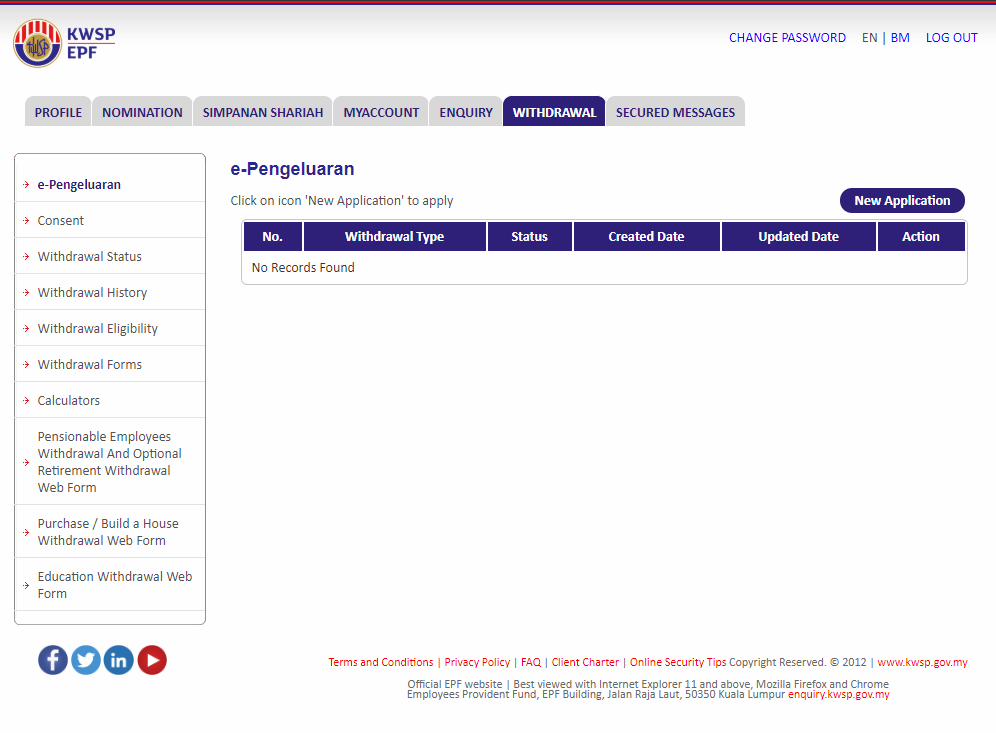

Kwsp withdrawal for house. Subsequent withdrawals can be made for the same house only. Epf withdrawals for medical payments and equipment. There are four options available and each carry a maximum withdrawal limit. Withdrawal is restricted to one house per member.

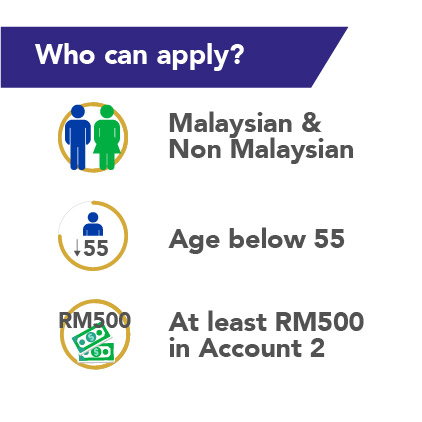

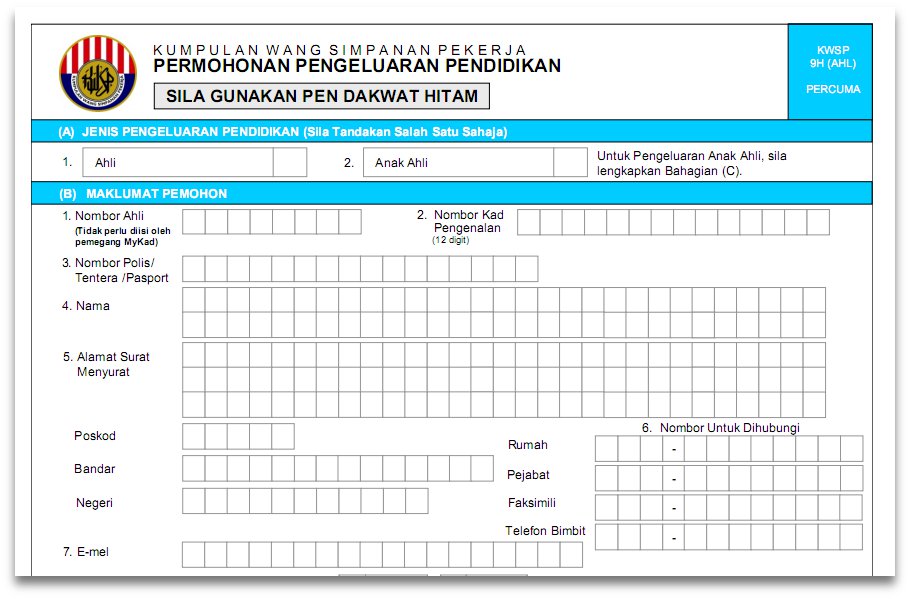

This withdrawal allows you to utilize your savings from account 2 to partially finance your purchase of a house. Ownership of transfer form ktn 14a in the name of the new owner completed by the land office or at least a completed and signed ownership of transfer form ktn 14a with the submission receipt by the land office. Epf withdrawals for housing. Health withdrawal to lessen the burden of treatment costs for couples who want to undergo fertility treatment.

When you reach a certain age owning your own home will be high on your list of things to. Epf allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. Buying of a house with another individual who has no kinship is allowed provided that the other individual is a buyer.

This is the most common form of epf withdrawal. When you reach a certain age the epf allows. Any proof of relationship must be submitted with transfer of house ownership based on love and affection subject to immediate family. Proof of sale disposal of first house.

Age 50 55 60 withdrawal. Epf reserves the right to cancel your monthly. 1 purchasing a home with a 100 home loan the maximum you may withdraw under a zero down home loan is 10 of the home. 2 buying a home as an individual you may withdraw the difference between the price of the home and.