Late Submission Penalty Lhdn

There are penalties imposed by lhdn without notice or notification one of it is under section 107c 9 of the income tax act 1967.

Late submission penalty lhdn. For example if your total taxable amount is just rm500 now you have to pay rm1 500 because of the 300 penalty. On top of that there ll be fines of rm1 000 to rm20 000 if the case is severe or imprisonment or even worse both. Purpose these guidelines explain the imposition of penalties on. Penalty as per income tax act ita 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences.

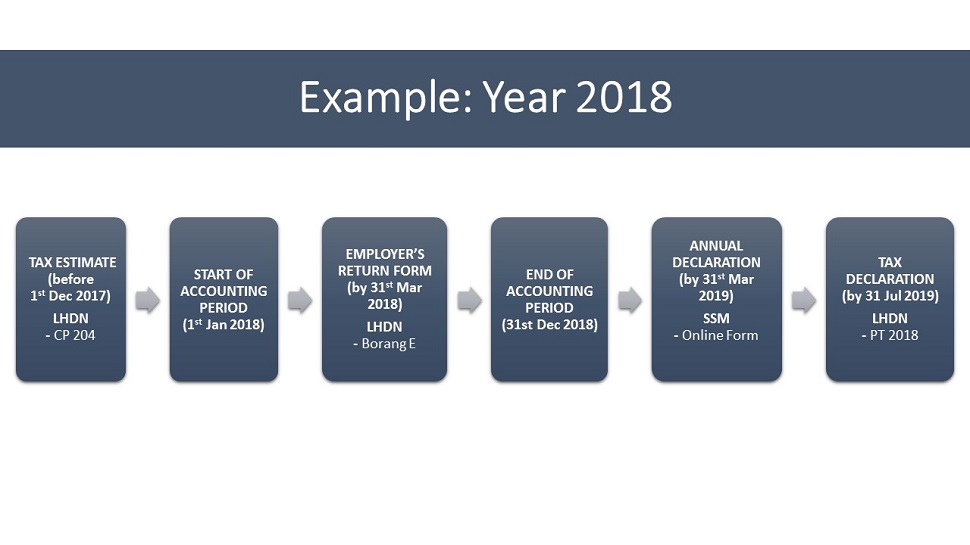

Penalty for late income tax payment. Penalty for late payment a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. Penalty late submission on tax payment lhdn. The following table is the summary of the offences fines penalties for each offence.

If the tax payable and penalty is still outstanding within 60 days from the due date an additional penalty of 5 will be imposed on the tax and penalty outstanding. Failure without reasonable excuse to give notice of chargeability to tax. The penalty is 10 of the unpaid amount. Penalty for late payment if the balance of tax payable is not paid by the due date a penalty of 10 will be imposed on the outstanding amount.

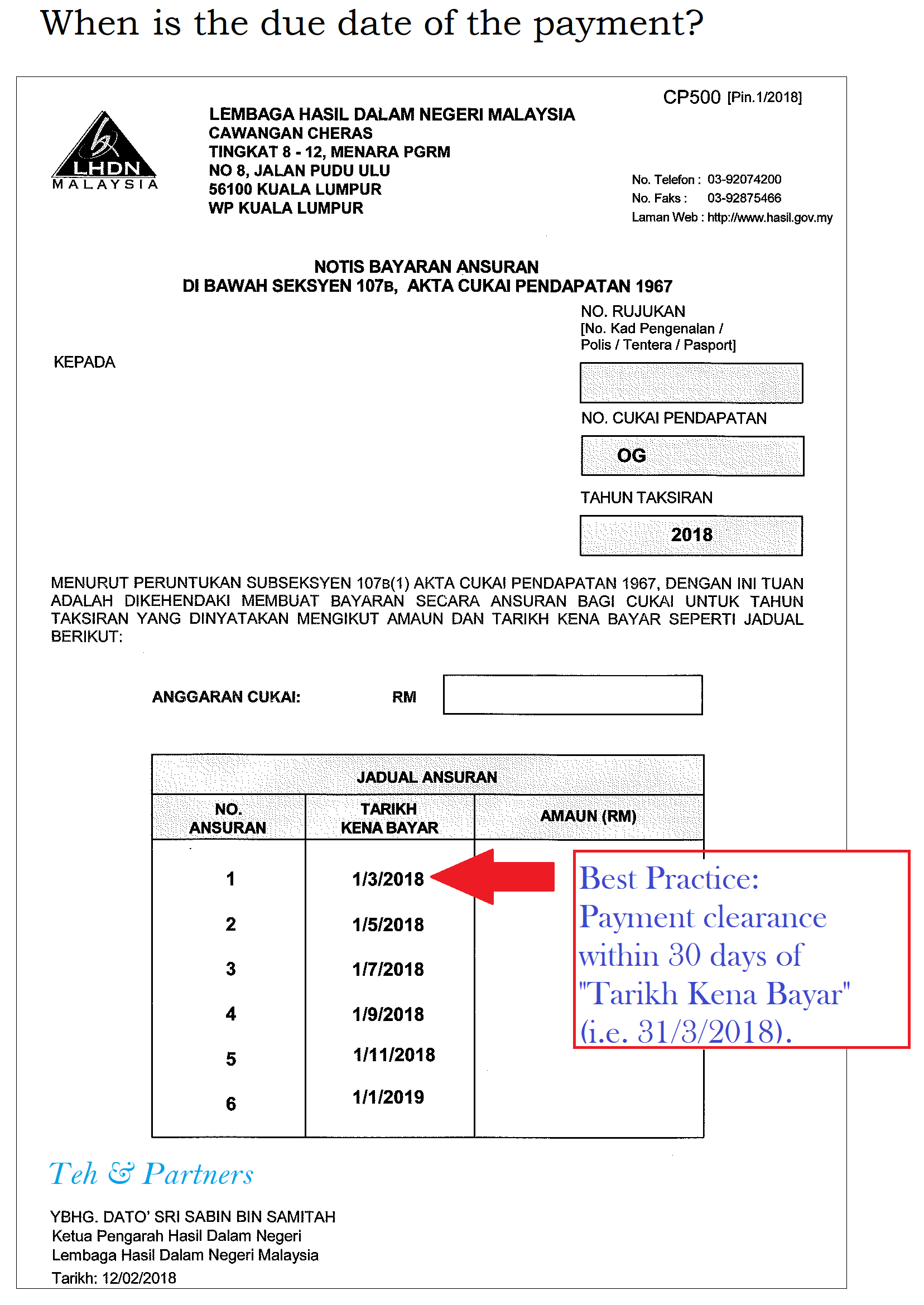

Failure without reasonable excuse to furnish an income tax return form. Penalty s 107 c 9 is imposed for amount of unpaid tax instalment cp204 without any notification to tax payer or tax agent. Penalty will be imposed for any payment made after the due date. For individual with employment no business income the dateline is 30th april while individual with business income the dateline is 30th june.

Taxpayers who are late or fail to submit a return form in. The period prescribed under the income tax act 1967 acp 1967 petroleum income tax act 1967 apcp 1967 and tax act. Hak cipta terpelihara 2015. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing.

112 1 200 00 to 20 000 00 imprisonment for a term not exceeding 6 months both. 112 1 200 00 to 20 000 00 imprisonment for a term not exceeding 6 months both. As per income tax act ita 1967 payment of income tax income tax has to be settle by the due date. Paparan terbaik menggunakan pelayar chrome internet explorer versi terkini atau mozilla firefox dengan resolusi skrin 1280x800.

That s a lot of money people.