Leave Passage Tax Treatment In Malaysia 2017

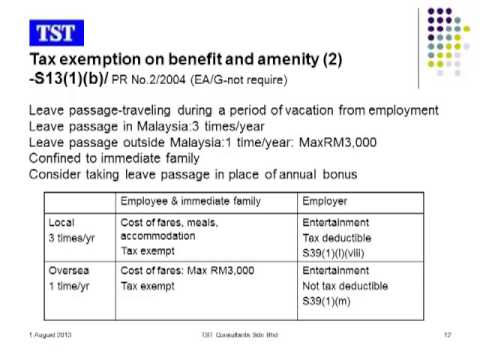

Leave passage can be categorized into the local leave passage and the overseas leave passage.

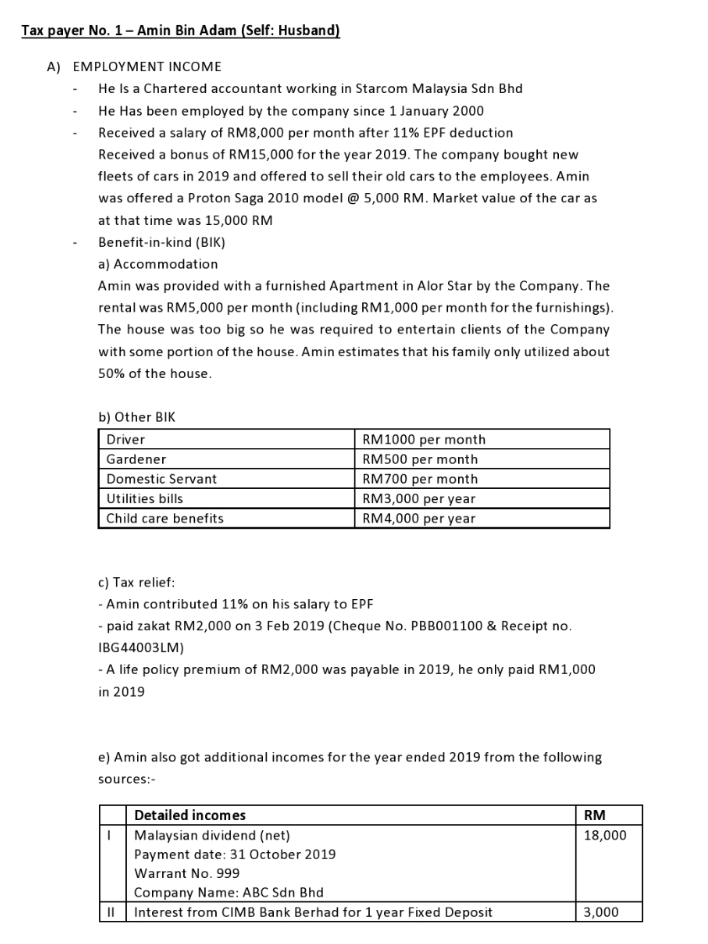

Leave passage tax treatment in malaysia 2017. 23 august 2007 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967. And 7 3 the treatment of leave passage expenditure whether within or outside malaysia incurred by the employer for the benefit of his employee as a non allowable deduction under the provisions of the act. Form of leave passage can be treated as gains or profits from an employment and charged to income tax under paragraph 13 1 b of the act. 1 2003 date of issue.

Leave passage is about an employee traveling during a period of vacation from employment. 1 leave passage leave passage refers to vacation time paid for by your employer and is divided into two categories. For local leave passage in malaysia an employee is entitled to a tax exemption of three times the amount spent on the cost of airfares meals and accommodations per year. And 7 3 the treatment of leave passage expenditure whether within or outside malaysia incurred by the employer for the benefit of his employee as a non allowable deduction under the provisions of the act.

You are entitled to tax exemption not exceeding three times in a year for leave passage within malaysia and one leave passage outside malaysia not exceeding rm3 000. These proposals will not become law until their enactment which is expected to be in early 2017 and may be amended in the course of its passage through parliament. Section 13 1 a leave pay leave pay is a cash item taxable under section 13 1 a. One leave passage outside malaysia is tax free up to a maximum amount of myr3 000 per year while three trips per year within malaysia remains tax free 33.

This includes the employee and his her immediate family. Leave passage local trip for managing director 20 staff training costs see below 110 salaries of directors 2 000 epf contributions for directors 500 the staff training was delivered by a non resident trainer and the costs include rm8 000 paid to a local hotel for the accommodation expenses incurred for the trainer s one week stay. Tax treatment of leave passage inland revenue board malaysia addendum to public ruling no. This booklet incorporates in coloured italics the 2017 malaysian budget proposals announced on 21 october 2016.

Income tax treatment of goods and services tax part ii qualifying expenditure for purposes of claiming allowances example 8 amended on 12 07 2017 08 06 2017. Leave passage can be treated as gains or profits from an employment and charged to income tax under paragraph 13 1 b of the act. I gross income from an employment includes an amount equal to the value. Tax treatment of leave passage addendum to public ruling no.