Legal Fee Calculator Malaysia

To comply with gdpr we will not store any personally identifiable information from you.

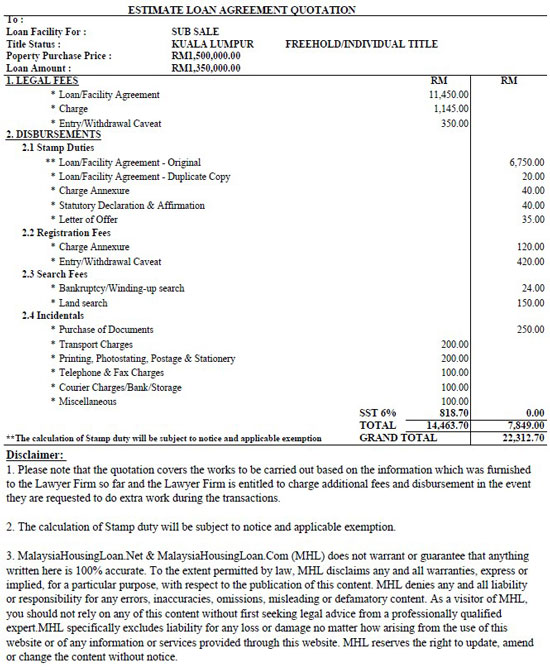

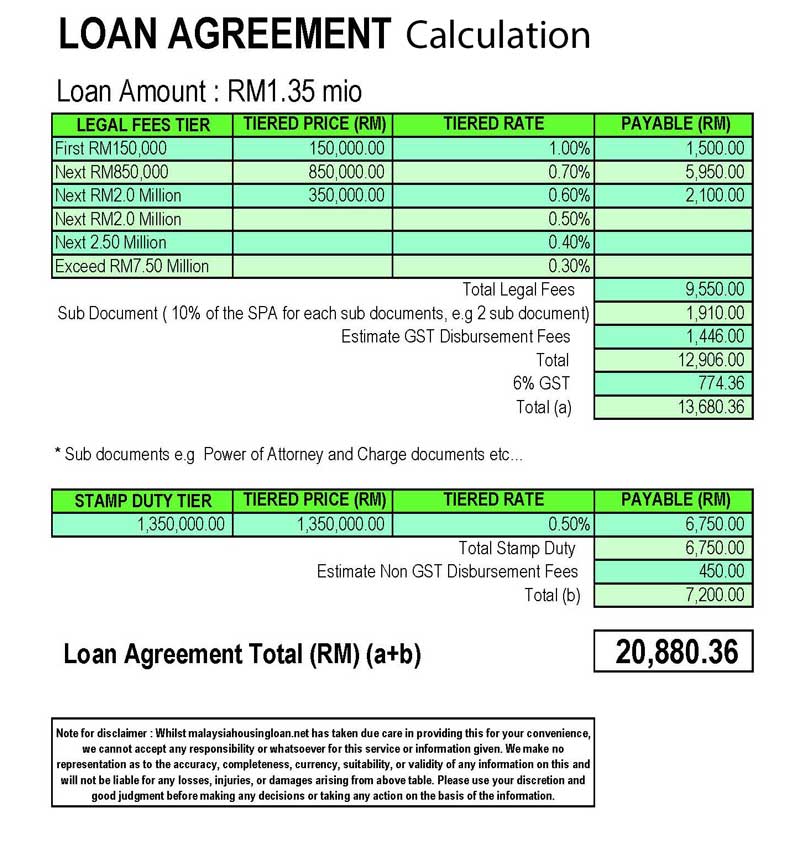

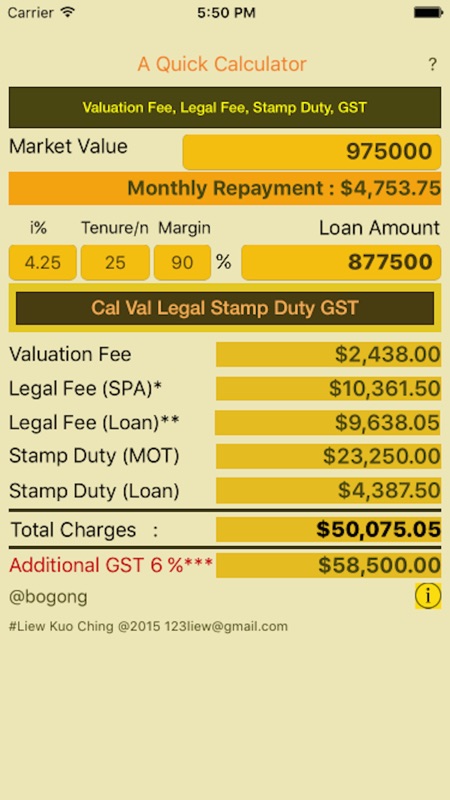

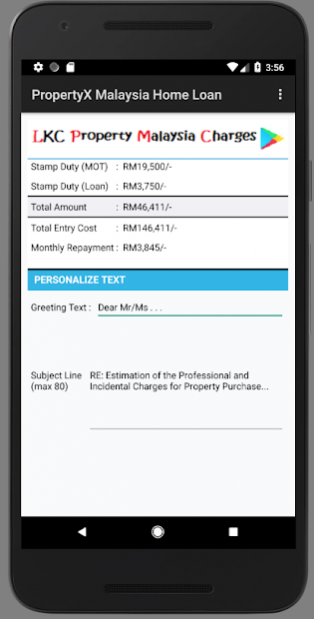

Legal fee calculator malaysia. Meanwhile if you wish to know more about the real property gain tax we recommend users to contact us or download easylaw mobile the no. Usually there are other fees and charges payable such as legal fees for subsidiary documents gst and other disbursements out of pocket expenses. 1 legal calculator app in malaysia. The calculation formula for legal fee stamp duty is fixed as they are governed by law.

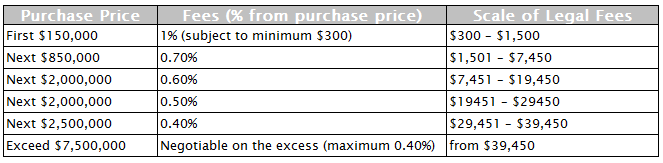

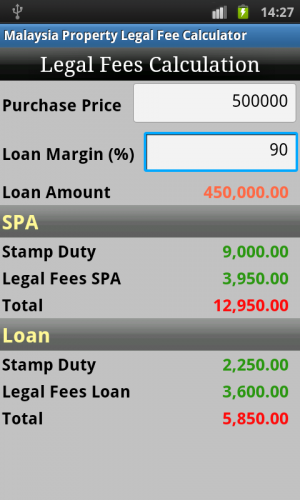

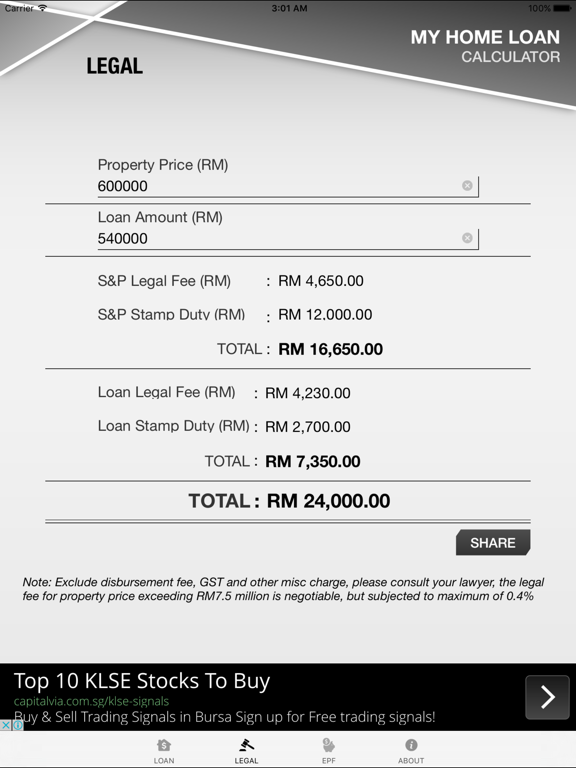

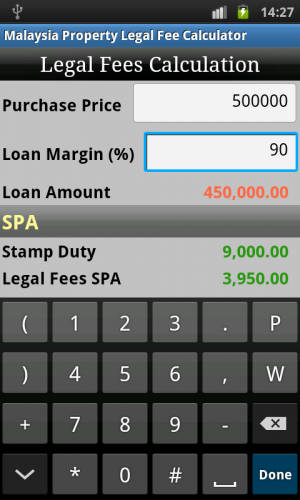

Here s an infographic of the 2020 fees for sale and purchase agreement stamp duty and legal fees in malaysia. The calculator will automatically calculate total legal or lawyer fees and stamp duty or memorandum of transfer mot. Legal fee and stamp duty calculator calculation of legal fees is governed by solicitors remuneration amendment order 2017 and calculation of stamp duties is governed by stamp act 1949. The above calculator is for legal fees and or stamp duty in respect of the principal document only.

Legal fees stamp duty calculation 2020 when buying a house in malaysia purchasing and hunting for a house can be exciting and stressful experience. For property price exceeding rm7 5 million legal fees of the excess rm7 5 million is negotiable but subjected to maximum of 0 5. For the next rm2 000 000. Please contact us for a quotation for services required.

Akta malaysia commissioner for oaths directory is available. The stamp duty fee for the first rm100 000 will be 100 000 1 rm1 000 the stamp duty fee for the remaining amount will be 300 000 100 001 2 rm4 000. For the first rm500 000 1 subject to a minimum fee of rm500 00 for the next rm500 000 0 80. The legal fee calculator does not include the disbursement payable.

For the next rm2 500 000. The calculation formula for legal fee stamp duty is fixed as they are governed by law. Find out the rates before you commit to buying that house. Easily calculate legal fees stamp duty rpgt.

Easylaw the best calculator phone app for malaysia lawyers. This means that for a property at a purchase price of rm300 000 the stamp duty will be rm5 000. Please contact us for a detailed quotation as the following tables exclude any taxes disbursements and reimbursement charges.