Lhdn 2017 Tax Rate

Pre existing individual account that was low value as at 30 june 2017 but meets the high value threshold as at the determination date of 31 december 2017 must be reviewed by 31 december 2018 and reported by 31 july 2019.

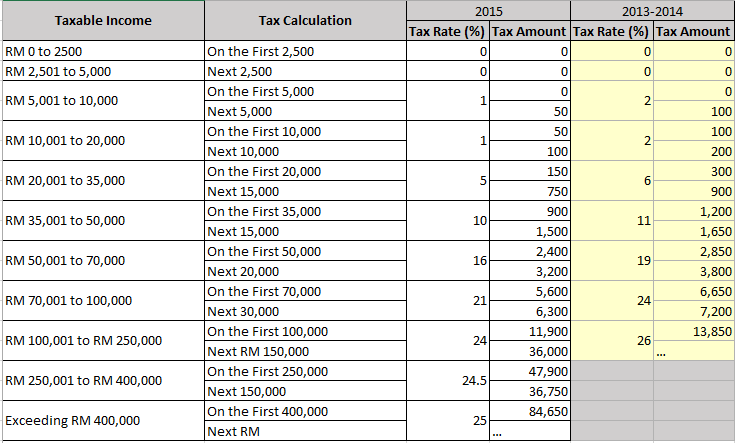

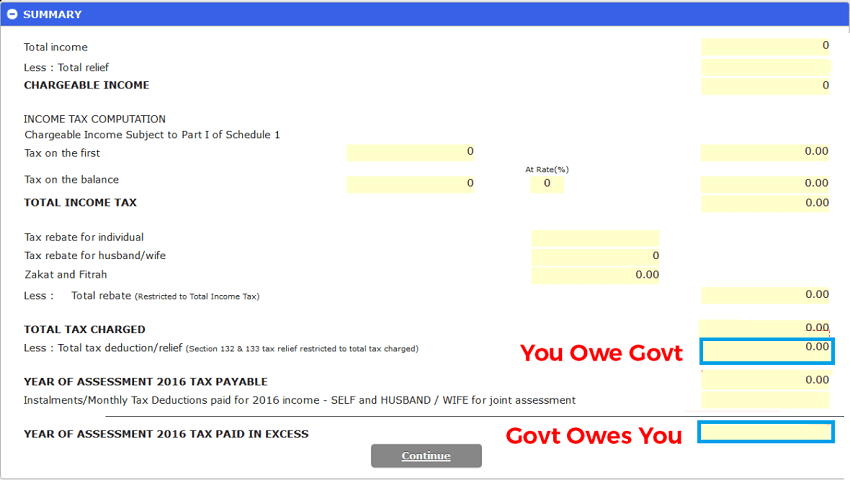

Lhdn 2017 tax rate. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. On the first 5 000 next 15 000. In malaysia for at least 182 days in a calendar year. Calculations rm rate tax rm 0 5 000.

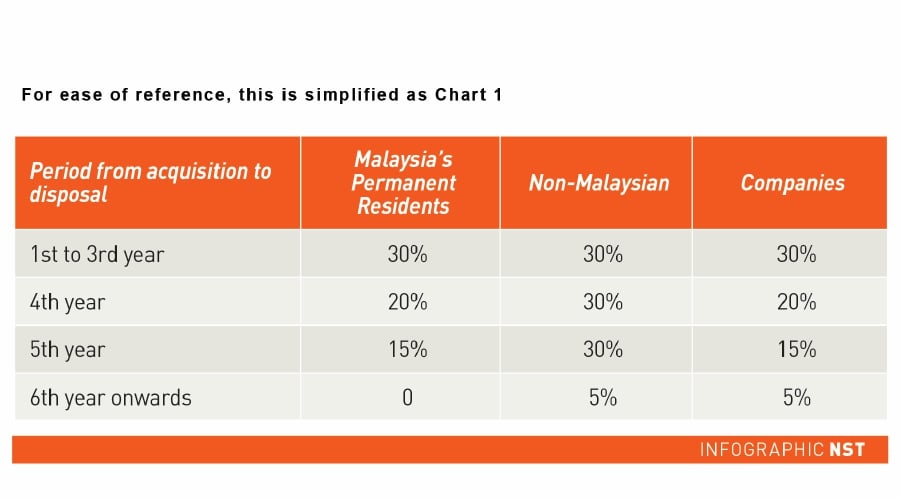

Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. Syarikat dengan modal berbayar tidak melebihi rm2 5 juta. Tahun taksiran 2017 2018. Income tax exemption order rates no country dividends interest royalties technical fees 1 taiwan nil 10 10 7 5 2 malaysia dta wht rate january 2017.

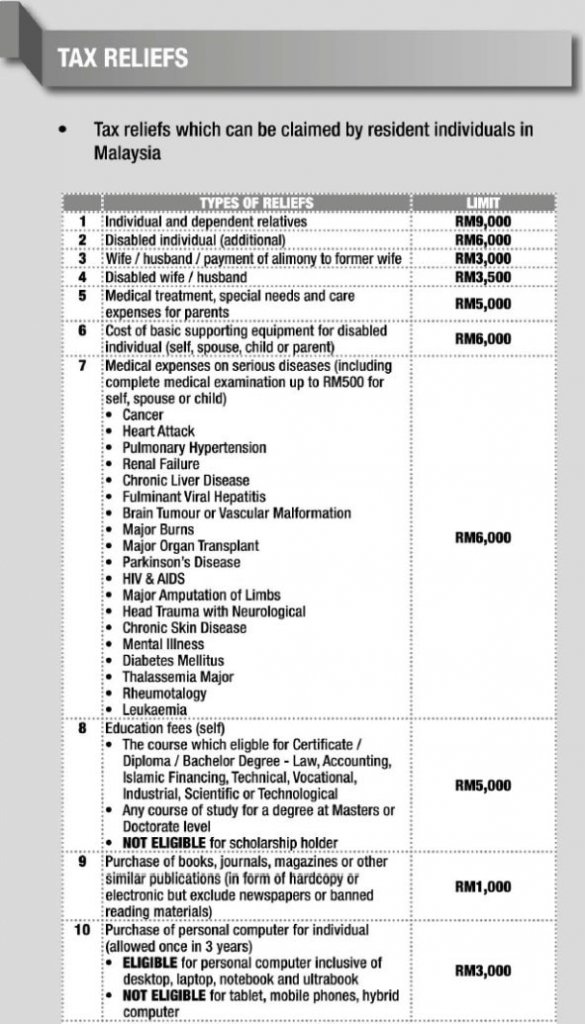

Mohamed effendy mohamed tajuddin created date. Pre existing individual accounts that are low value accounts on 30 june 2017 must be reviewed by 30 june 2019. According to lembaga hasil dalam negeri lhdn with effect from year 2016 an individual who earns an annual employment income of rm 25 501 after deduction of epf has to register a tax file. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

The withholding tax rate on interest royalties and fees for technical services is as provided in the ita 1967. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Tax administration diagnostic assessment tool tadat. Pengiraan rm kadar cukai rm 0 5 000.

This relief is applicable for year assessment 2013 and 2015 only. Company with paid up capital more than rm2 5 million. Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini. Ben is earning a rm 40 000 per year salary.

Tahun taksiran 2016 dan 2017. Company with paid up capital not more than rm2 5 million. Tax administration diagnostic assessment tool tadat. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia.

Income tax rates 2020 malaysia.