Lhdn 2018 Tax Relief

Your epf contributions are eligible for tax relief.

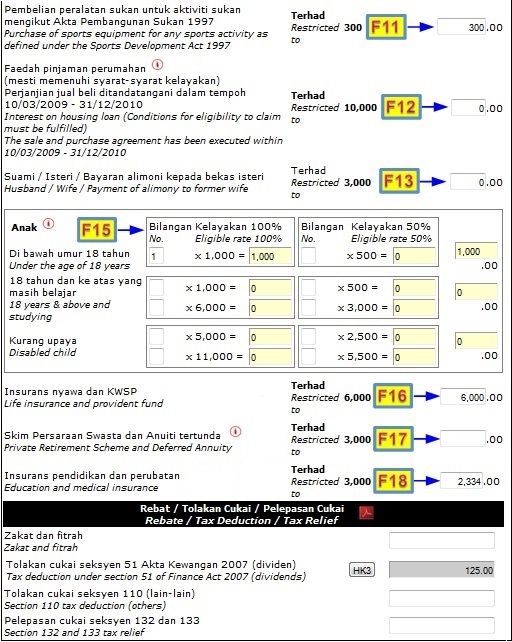

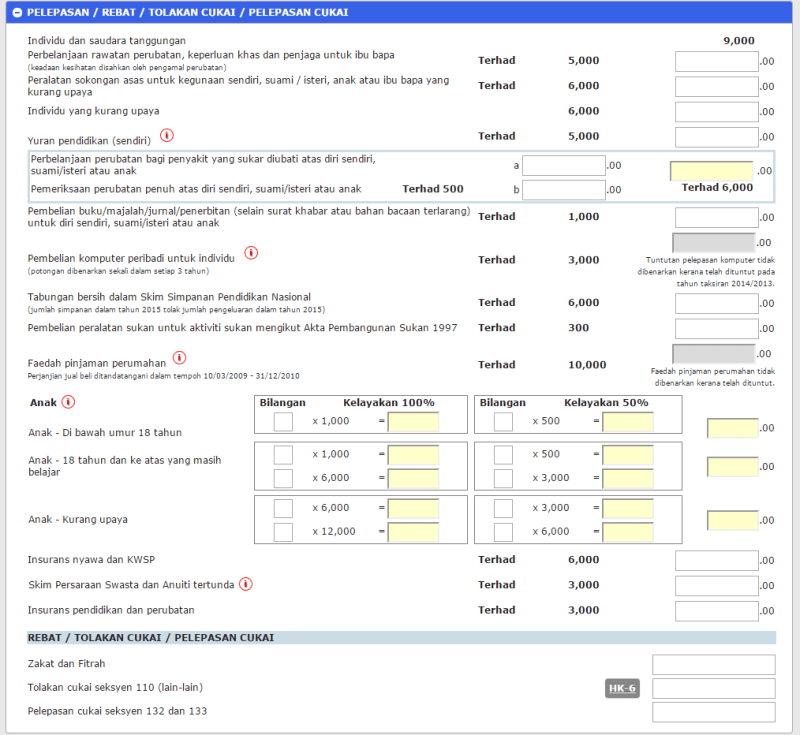

Lhdn 2018 tax relief. With effective from the assessment year 2016 lhdn started to have tax relief up to rm250 for contribution to socso. Sspn jumlah simpanan dalam tahun 2018 tolak jumlah pengeluaran dalam tahun 2018 6 000 terhad 12. Medical expenses for parents. But it does still play a role in my 2018 personal tax relief.

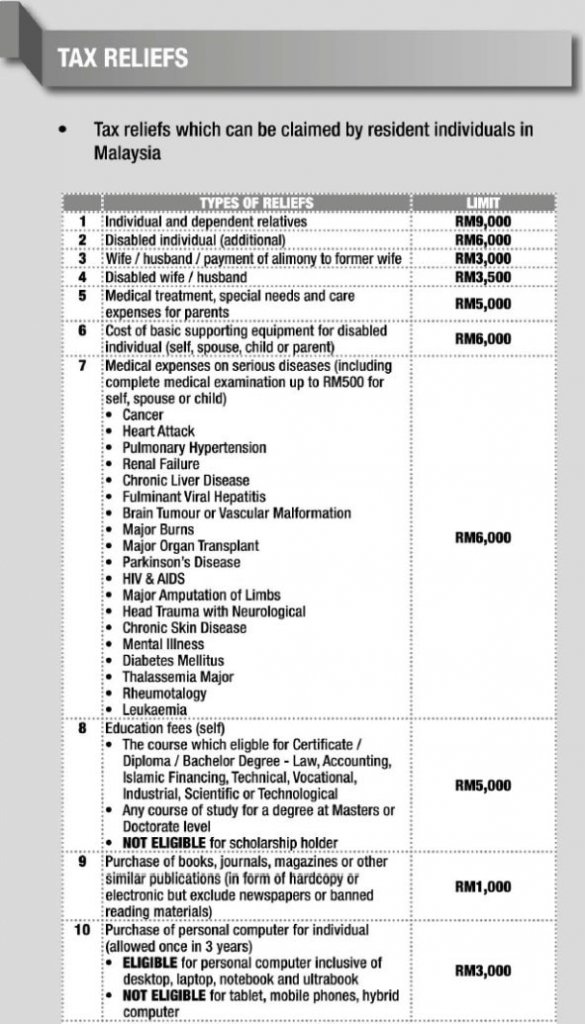

The relief amount you file will be deducted from your income thus reducing your taxable income make sure you keep all the receipts for the payments. Calculations rm rate tax rm 0 5 000. What is a income tax relief. These are for certain activities or behaviours that the government encourages or even necessities or burdens to lighten our financial loads.

Personal tax relief malaysia 2020. Below is the list of tax relief items for resident individual for the assessment year 2019. The best way to know is to calculate your taxes using the calculator on lembaga hasil dalam negeri s lhdn website. This relief is applicable for year assessment 2013 and 2015 only.

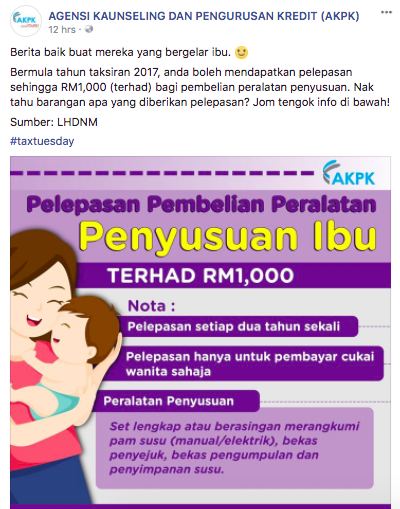

Remember some purchases such as electronic products books health insurance or medical card are entitled to tax reliefs. This special program is part of the government s efforts in tax reformation. Parents guardians and also legally adoptive parents who have sspn i accountsfor their children will enjoy tax relief up to rm6 000 a year on the net amount deposited. Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini.

Amount rm 1. On the first 2 500. On the first 5 000 next 15 000. It is to encourage taxpayers to make voluntary disclosure in reporting their income to increase tax collection for the country s development.

This voluntary disclosure can be made at the nearest irbm office commencing from 3rd november 2018 until 30th september 2019. Because i left my full time employment in july 2018 my contribution to socso is only about rm110 for the year 2018. If you don t mind having not having a higher take home monthly salary you can request for your employer to bump your monthly epf. Tax administration diagnostic assessment tool tadat.

Tax reliefs are set by lhdn where a taxpayer is able to deduct a certain amount for money expended in that assessment year from the total annual income. Lembaga hasil dalam negeri. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. 5 000 limited 3.

Net saving in sspn s scheme total deposit in year 2018 minustotal withdrawal in year 2018 rm6 000 limited another tax relief that will benefit families out there.