Lhdn Benefit In Kind 2015

Refinery petrochemical 35 collection of tax 10 integrated development rapid corporate income tax 10 j.

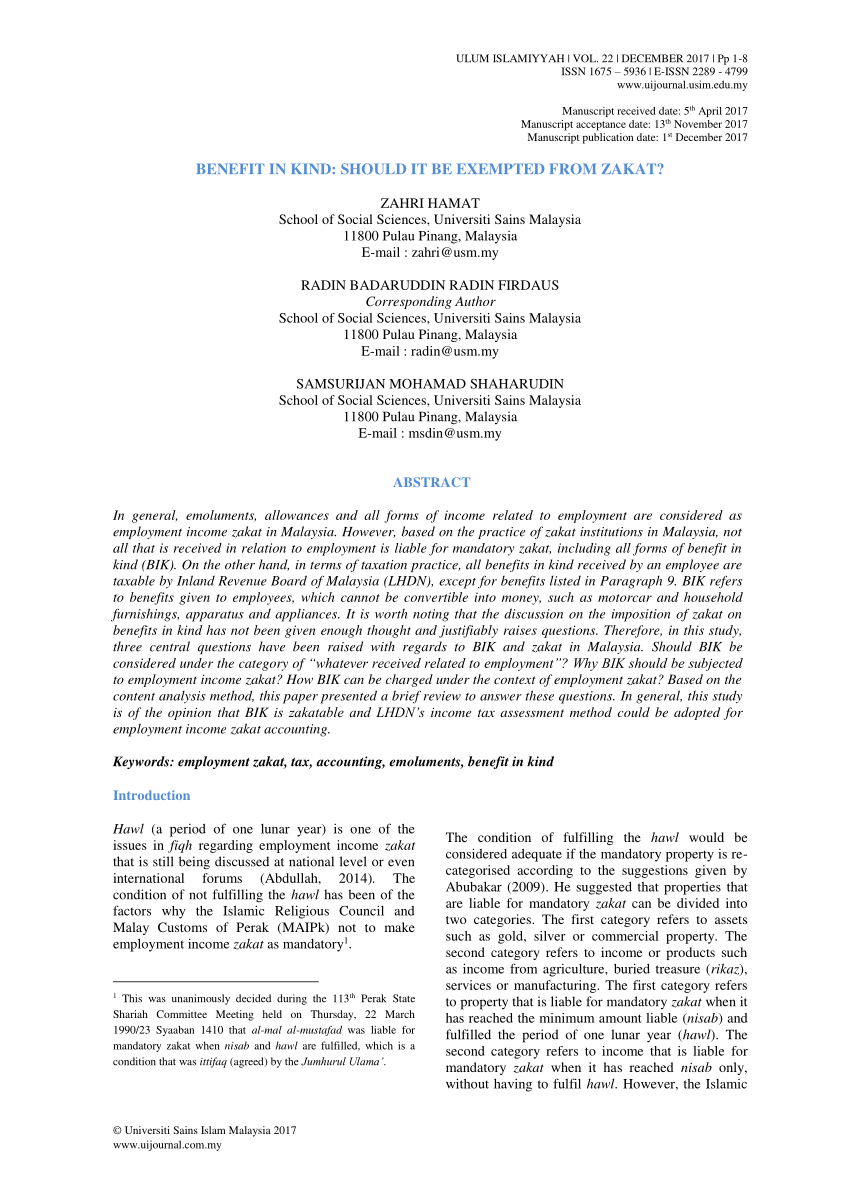

Lhdn benefit in kind 2015. A further clarification on benefits in kind in the form of goods and services offered at discounted prices. 3 2013 date of issue. Objective the objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Logistic 38 profit distribution 12 m.

Employee by or on behalf of the employer. Annual value of benefit value of asset asset s lifespan. Generally non cash benefits e g. 4 4 vola is living accommodation benefit provided for the employee by or on behalf of the employer.

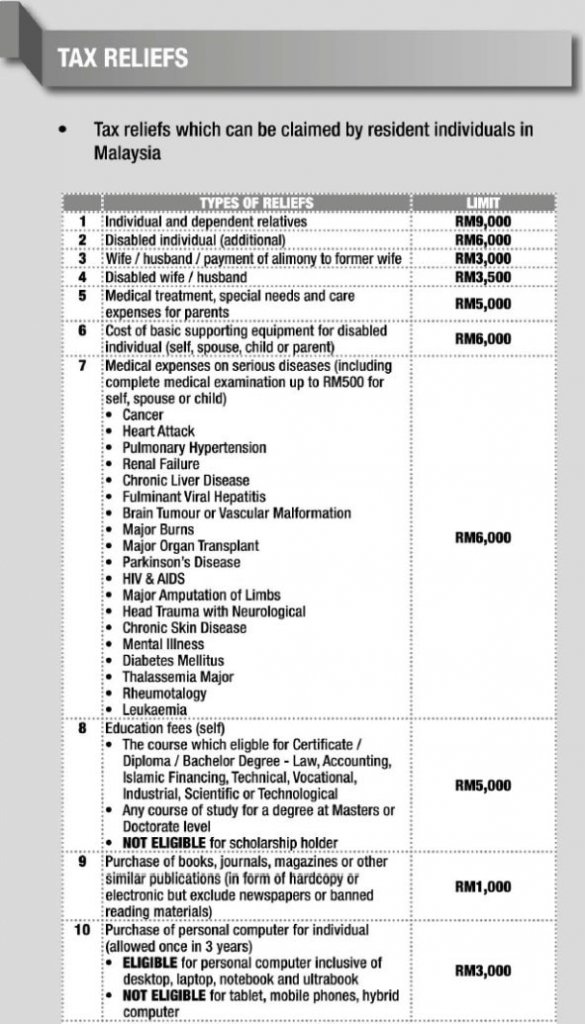

Employees responsibilities 23 11 monthly tax deduction 23 12. Ascertainment of the value of benefits in kind 3 6. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. These benefits are called benefits in kind bik.

Accommodation or motorcars provided by employers to their employees are treated as income of the employees. These benefits are categorised as gross income from employment under paragraph 13 1 b of the ita. Particulars of benefits in kind 4 7. And one should also be awar.

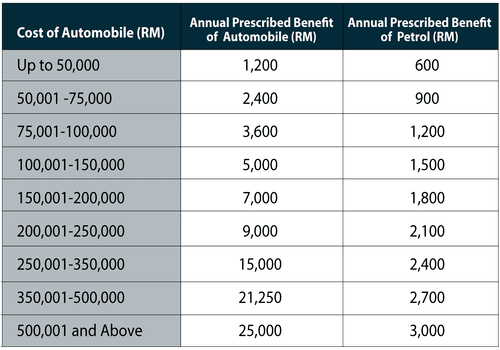

Benefits in kind bik. Assigns a predetermined valued from a list sorted by classification of asset. On the other hand in terms of taxation practice all benefits in kind received by an employee are taxable by inland revenue board of malaysia lhdn except for benefits listed in paragraph 9. As benefits in kind has no equivalent monetary value their value for taxation purposes are calculated using one of the following methods.

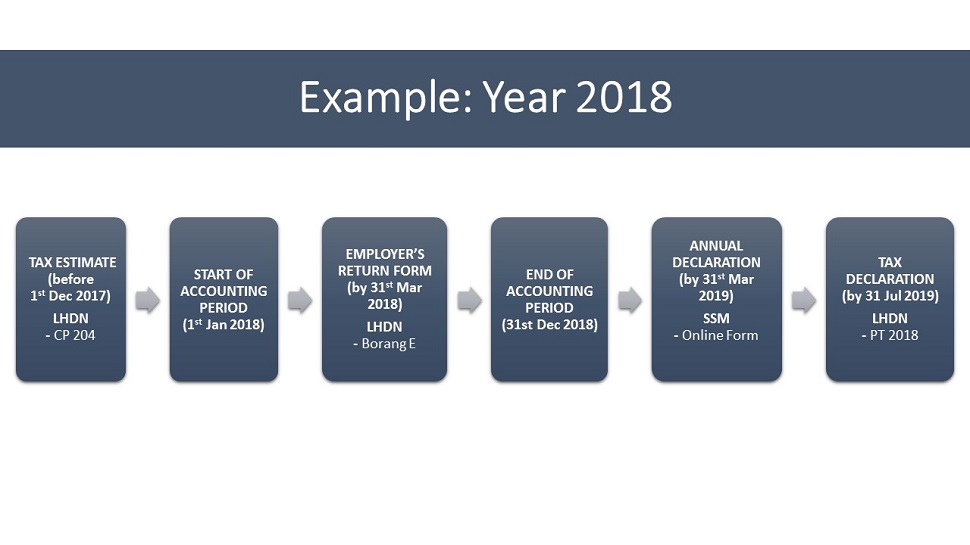

Regional operations 35 residence status 10 k. Benefits in kind public ruling no. Benefits in kind bik 8 i. From 1 january 2015 benefit in kind bik and value of living accommodation vola are part of remuneration which is subject to schedular tax deductions std.

Special economic corridors 39. Tax exemption on benefits in kind received by an employee 14 9. Other benefits 14 8. Benefits in kind 2 5.

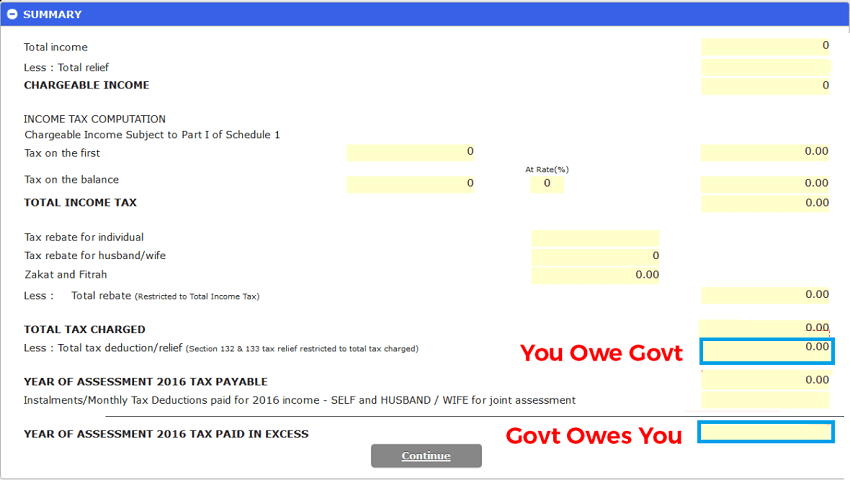

6 2 paragraph 39 1 p of the ita stipulates that gst paid or to be paid as. Employer s responsibilities 22 10. The tax treatment on bik is explained in detail in the pr no. There are several tax rules governing how these benefits are valued and reported for tax purposes.

Benefits in kind dated 15 march 2013. Deduction claim 24 13. Research and development 37 income tax rates 10 r d collection of tax 11 l. 15 march 2013 pages 1 of 31 1.

The prescribed value method.