Lhdn Individual Tax Rate

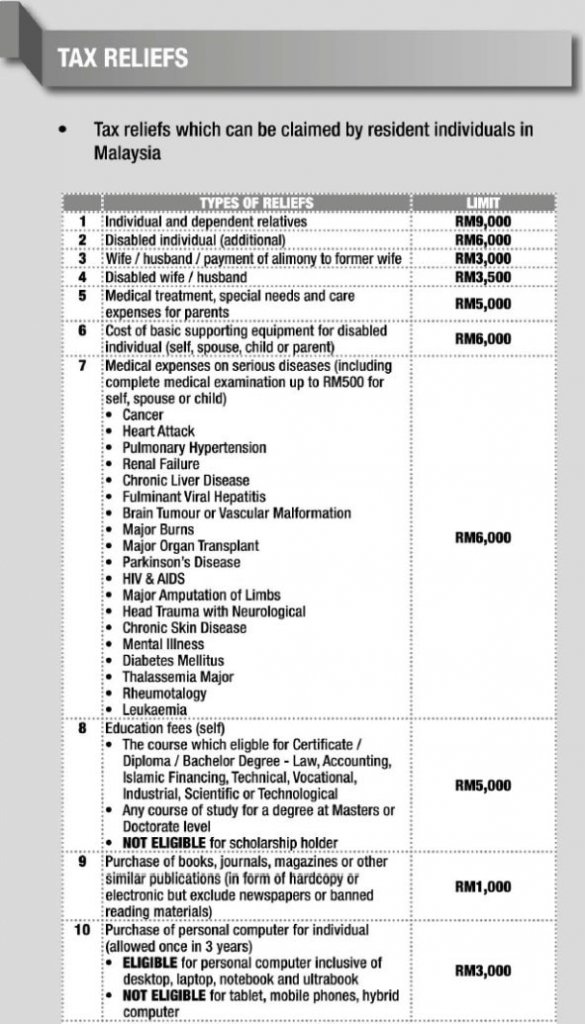

6 000 restricted 4.

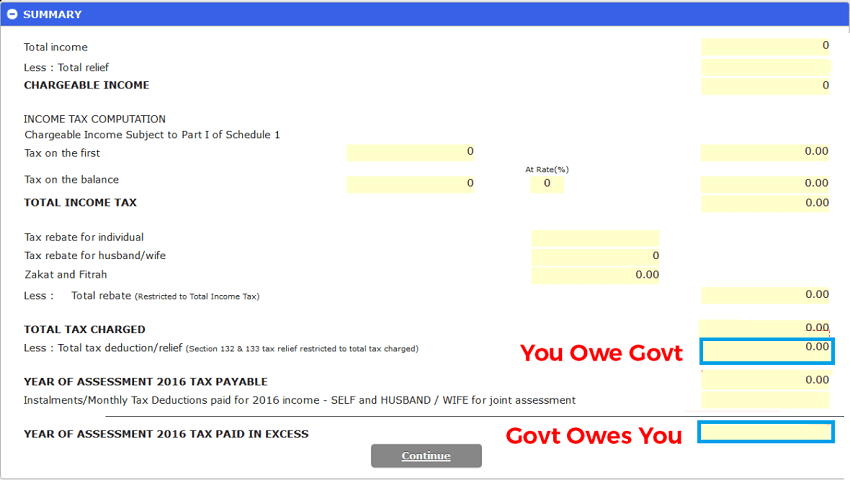

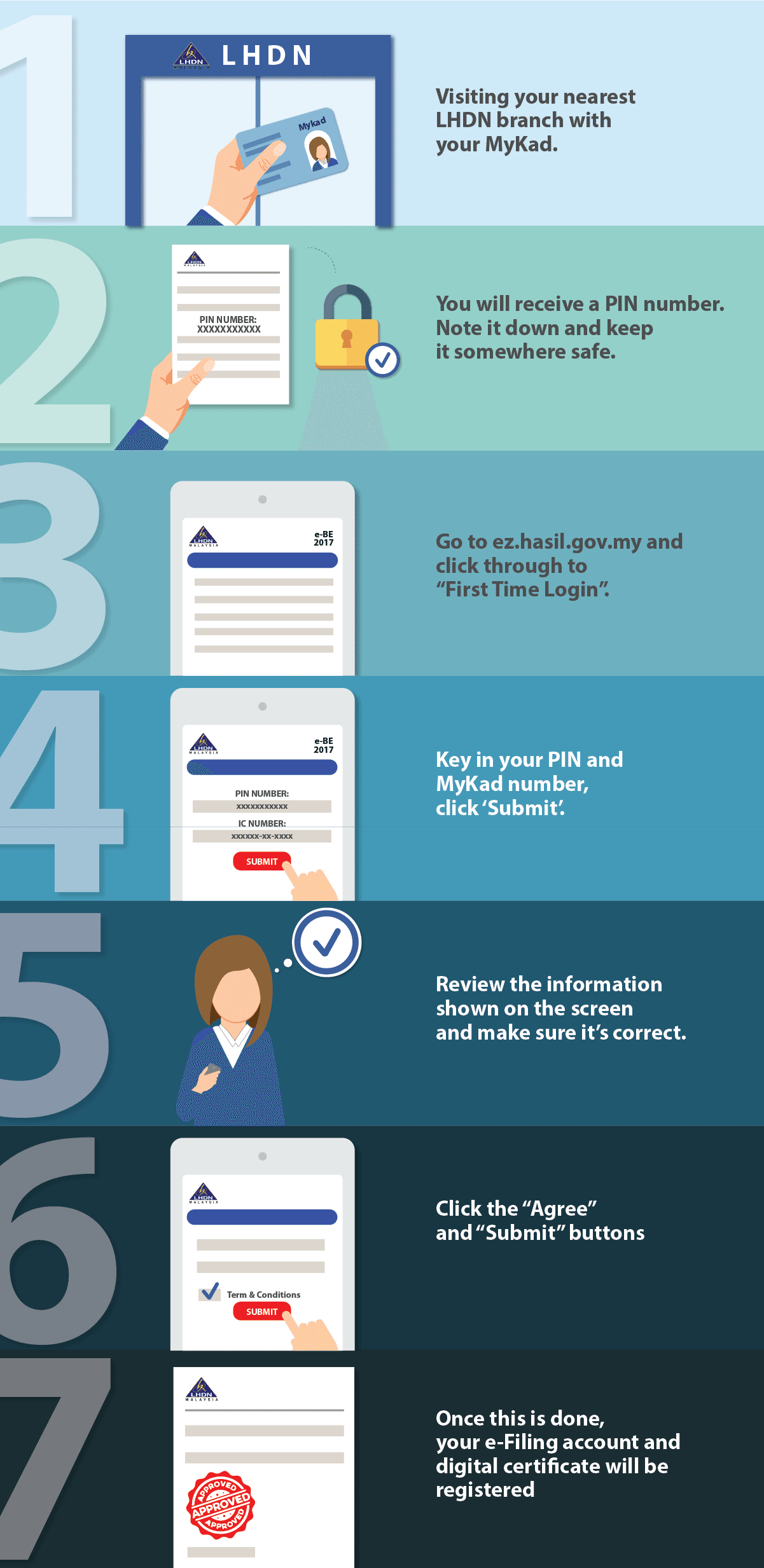

Lhdn individual tax rate. What is a tax deduction. To compute their tax payable. Jadual average lending rate bank negara malaysia seksyen 140b. What is tax rebate.

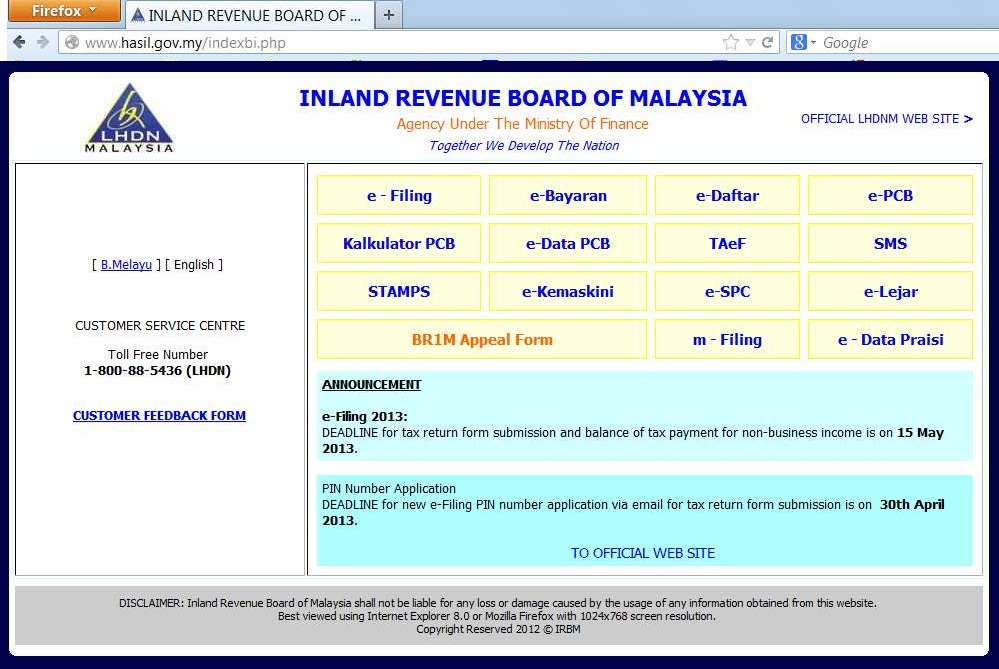

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. Sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja.

Jadual average lending rate bank negara malaysia seksyen 140b. Lembaga hasil dalam negeri malaysia inland revenue board of malaysia. The new rates are now 10 12 22 24 32 35 and 37. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000.

Sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja. Tax administration diagnostic assessment tool tadat. All supporting documents like business records cp30 and receipts need not be submitted with form p. What is chargeable income.

Basic supporting equipment for disabled self spouse child or parent. On the first 5 000 next 15 000. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. What is a tax exemption.

Malaysia personal income tax guide for 2020. Income tax rates 2020 malaysia. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

To check and sign duly completed income tax return form. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. On the first 2 500. Education fees self other than a degree at masters or doctorate level course of study in law accounting islamic financing technical vocational industrial scientific or technology.

Husband and wife have to fill separate income tax return forms. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. To submit the income tax return form by the due date.