Lhdn Tax Rate 2019 Individual

The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates.

Lhdn tax rate 2019 individual. Malaysia income tax e filing. On the first 2 500. Income tax rates 2020 malaysia. 18 of taxable income.

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. What is tax rebate. 2019 tax year 1 march 2018 28 february 2019 taxable income r rates of tax r 1 195 850. Calculations rm rate tax rm 0 5 000.

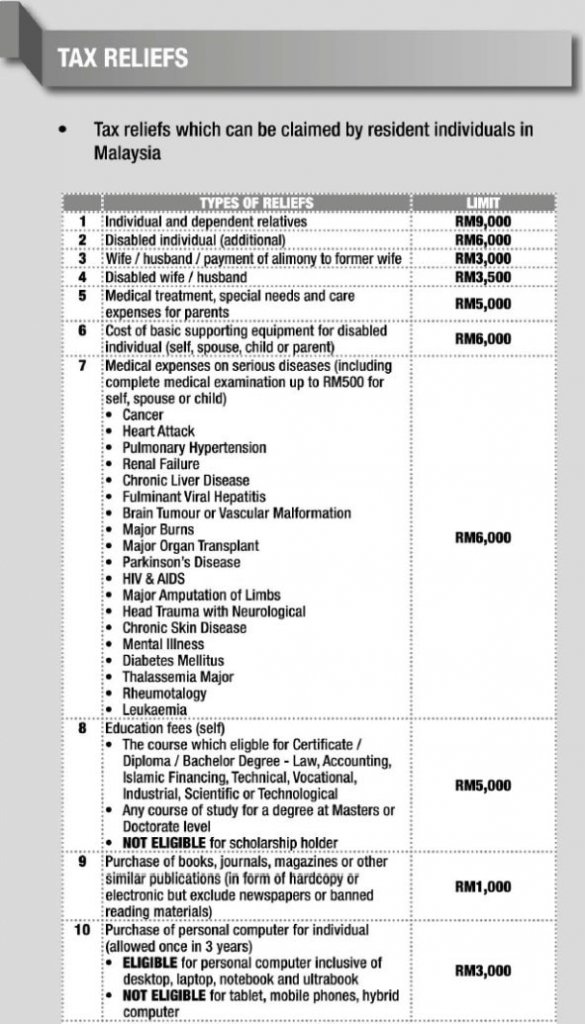

Rates of tax for individuals. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. 2021 tax year 1 march 2020. 195 851 305 850.

Now that you re up to speed on whether you re eligible for taxes and how the tax rates work let s get down to the business of actually filing your taxes. 305 851 423 300. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini. An approved individual under the returning expert programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in malaysia for 5 consecutive yas. Your playlist will load after this ad it would mean people are taxed 39 per cent on any income earned. How does monthly tax deduction mtd pcb work in malaysia.

Tax administration diagnostic assessment tool tadat. On the first 5 000 next 15 000. What is income tax return. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia.

You can file your taxes on ezhasil on the lhdn website. The deadline for filing income tax in malaysia is 30 april 2019 for manual filing and 15 may 2019 via e filing. Tahun taksiran 2018 2019. What is a tax deduction.