Lhdn Tax Relief 2018

Your real estate property is an apartment flat landed or anything otherwise legally designated as residential title.

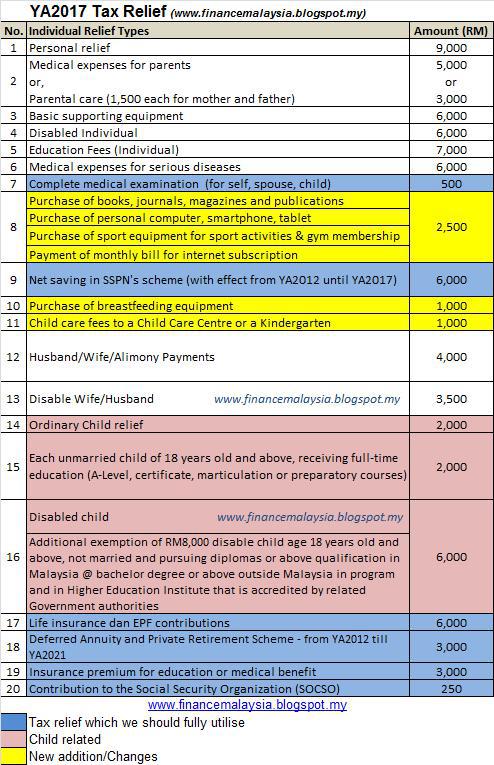

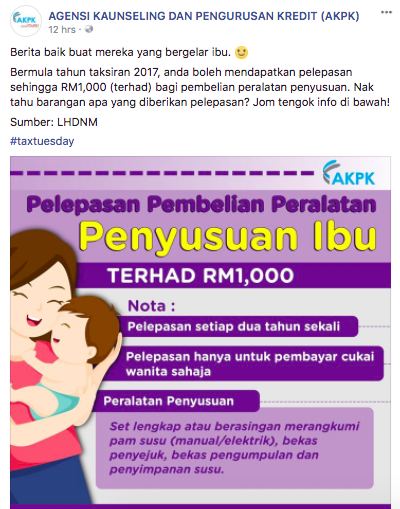

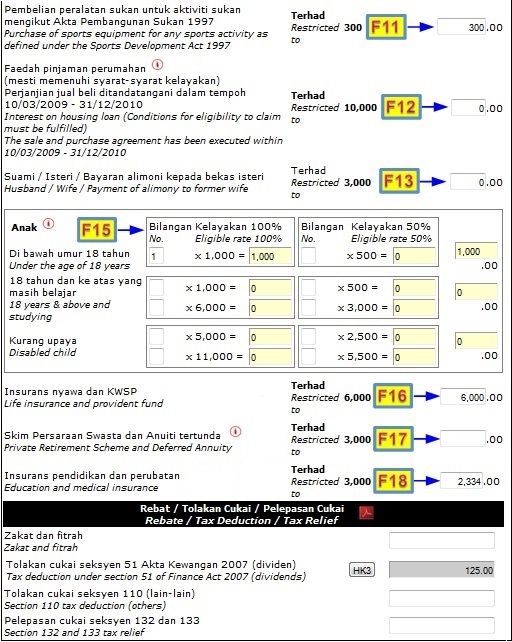

Lhdn tax relief 2018. Because i left my full time employment in july 2018 my contribution to socso is only about rm110 for the year 2018. Medical expenses for parents. To compute their tax payable. Tahun taksiran 2018 2019.

For instance you will receive tax relief up to rm3 000 for health insurance and medical card. Pengiraan rm kadar cukai rm 0 5 000. These are for certain activities or behaviours that the government encourages or even necessities or burdens to lighten our financial loads. To be eligible for this tax exemption you need to fulfill these requirements.

All supporting documents like business records cp30 and receipts need not be submitted with form p. For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. Introduced in budget 2018 rental income from residential investment properties would be eligible for a 50 exemption from income tax. This voluntary disclosure can be made at the nearest irbm office commencing from 3rd november 2018 until 30th september 2019.

This special program is part of the government s efforts in tax reformation. This relief is applicable for year assessment 2013 and 2015 only. To check and sign duly completed income tax return form. Tax administration diagnostic assessment tool tadat.

It is to encourage taxpayers to make voluntary disclosure in reporting their income to increase tax collection for the country s development. Remember some purchases such as electronic products books health insurance or medical card are entitled to tax reliefs. Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini. To get your hand on the completed forms you will need to visit lhdn s site for your tax submission.

Parents guardians and also legally adoptive parents who have sspn i accountsfor their children will enjoy tax relief up to rm6 000 a year on the net amount deposited. Amount rm 1. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Husband and wife have to fill separate income tax return forms.

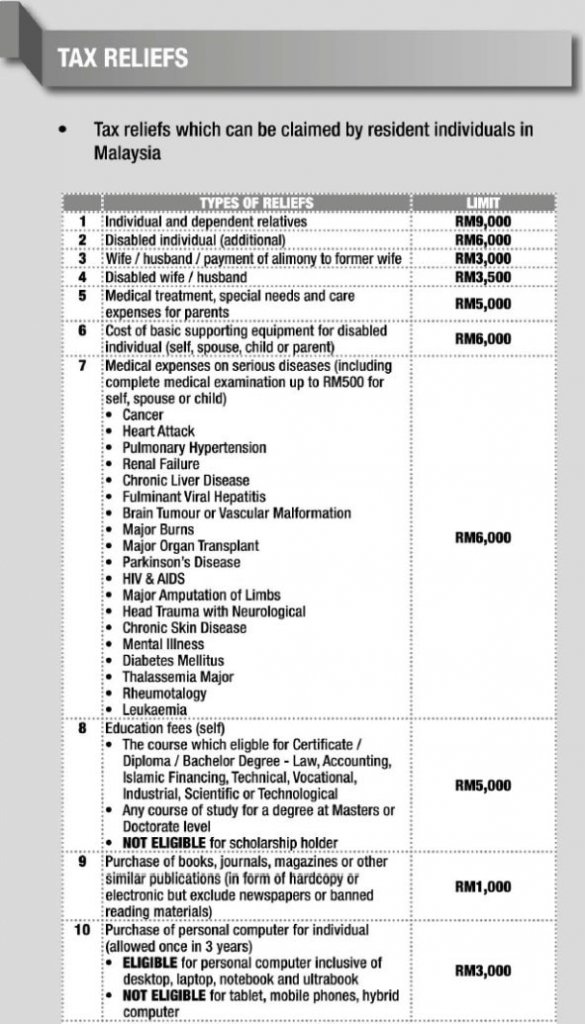

5 000 limited 3. To submit the income tax return form by the due date. Tax filing season has begun in malaysia and the task of trying to save money through claiming tax relief and rebates can be confusing. To help make things a little clearer we run through the list of all items eligible for tax relief with explanations for some of the more confusing entries.