List Of Double Deduction Malaysia

Ii for technical services obtained overseas but undertaken in malaysia the expenditure for the technical services will be allowed for double deduction.

List of double deduction malaysia. Companies with msc malaysia status enjoy a set of incentives and benefits that is backed. Examples of assets used in a business are motor vehicles machines office equipment furniture and computers. Will be allowed for double deduction. Timber companies in sabah can deduct double the amount of freight charges incurred.

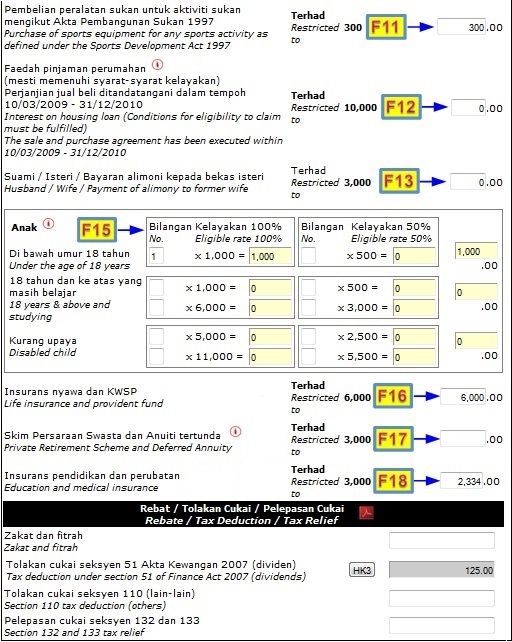

A addendum page 2 of 5 of being given a double deduction for each relevant year of assessment. Double deduction for awarding scholarship. Pengesahan dikeluarkan oleh matrade pihak berkuasa yang meluluskan pengesahan penyertaan pameran antarabangsa di luar negera. Malaysia would be eligible for a claim for double deduction.

Freight charges certain manufacturing industries located in certain regions of the country e g. Conditions for claiming capital allowance are. However ordinary allowable expenditure incurred locally such as raw materials travelling transportation etc. Syarat kelayakan dan dokumen sokongan yang perlu dikemukakan adalah sama seperti permohonan potongan cukai dua kali bagi pameran antarabangsa dalam negeri.

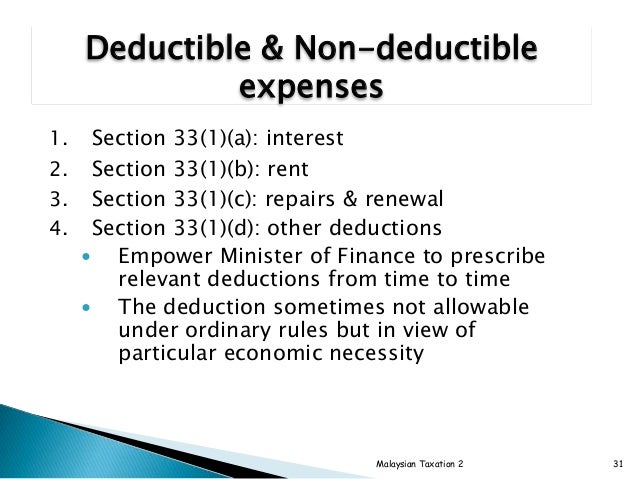

Double deduction incentive on research expenditure. 3 april 2008 issue. Or deduction granted for that ya under the income tax act 1967. Additionally any expenses incurred by standards malaysia or certification bodies in subsequent years of assessment after certification of quality and standard system certificates is obtained are justified deductions under section 33 1 of the ita 1967 as indicated under item 4 5 of the document titled garis panduan bagi potongan.

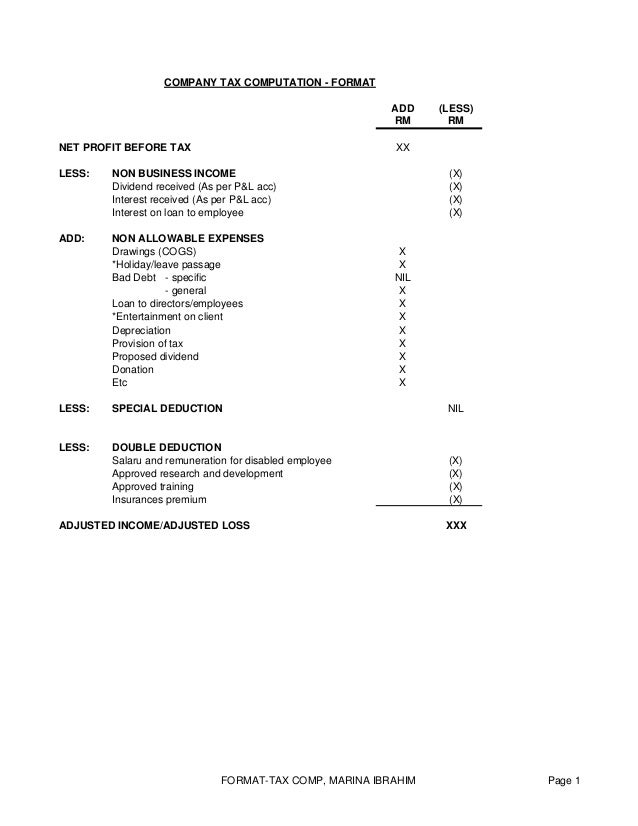

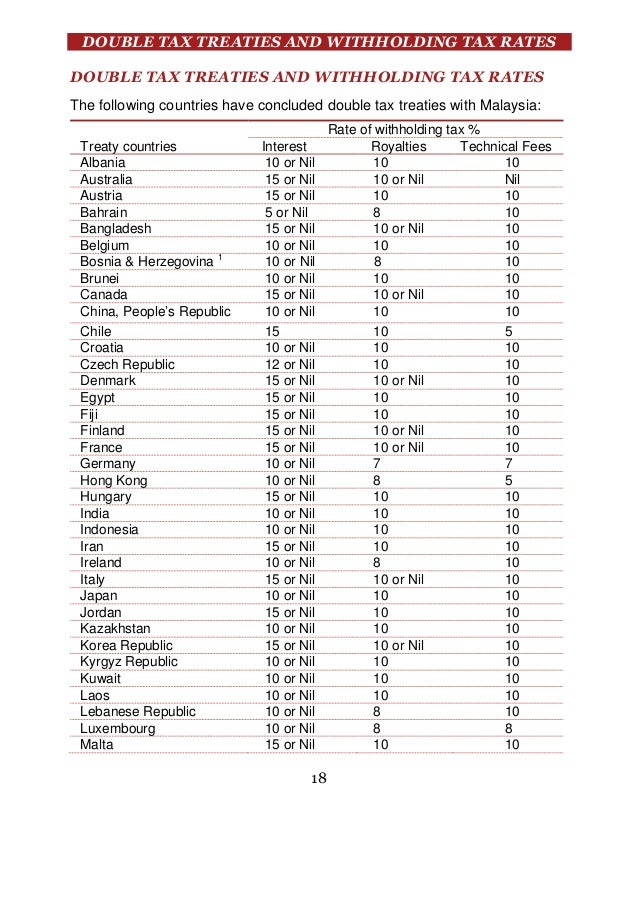

These expenses must be incurred specifically in undertaking in house research by that person in relation to his business. Brand promotion advertising expenditure incurred promoting an export quality standard malaysian owned product is subject to double tax deduction. Double tax treaties and withholding tax rates real property gains tax stamp duty. Double deduction incentive on research expenditure inland revenue board malaysia addendum to public ruling no.

Scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking. Promotion of a brand name means making a name internationally known and therefore would include such expenditure as bill boards in international airports or highways. A ruling is issued for the purpose of providing guidance for the public and officers of the inland revenue board of malaysia. The said research must be approved by the minister of finance.

Msc malaysia status is the recognition granted by the government of malaysia through the multimedia development corporation mdec to companies that participate and undertake ict activities in the msc malaysia. 5 2004 date of issue. Is given as deduction from business income in place of depreciation expenses incurred in purchase of business assets.

.jpg)