List Of Non Allowable Expenses In Malaysia 2017

However from 17 january 2017 to 5 september 2017 2018 2019 malaysian tax booklet 2018 2019 malaysian.

List of non allowable expenses in malaysia 2017. Unrealised foreign exchange loss. List of nondeductible tax expenses that might not qualify as tax deductions on your federal and or state income tax return. Purchased from a non resident person 10 dividends single tier exempt. 2 2010 03 06 2010 refer year 2010.

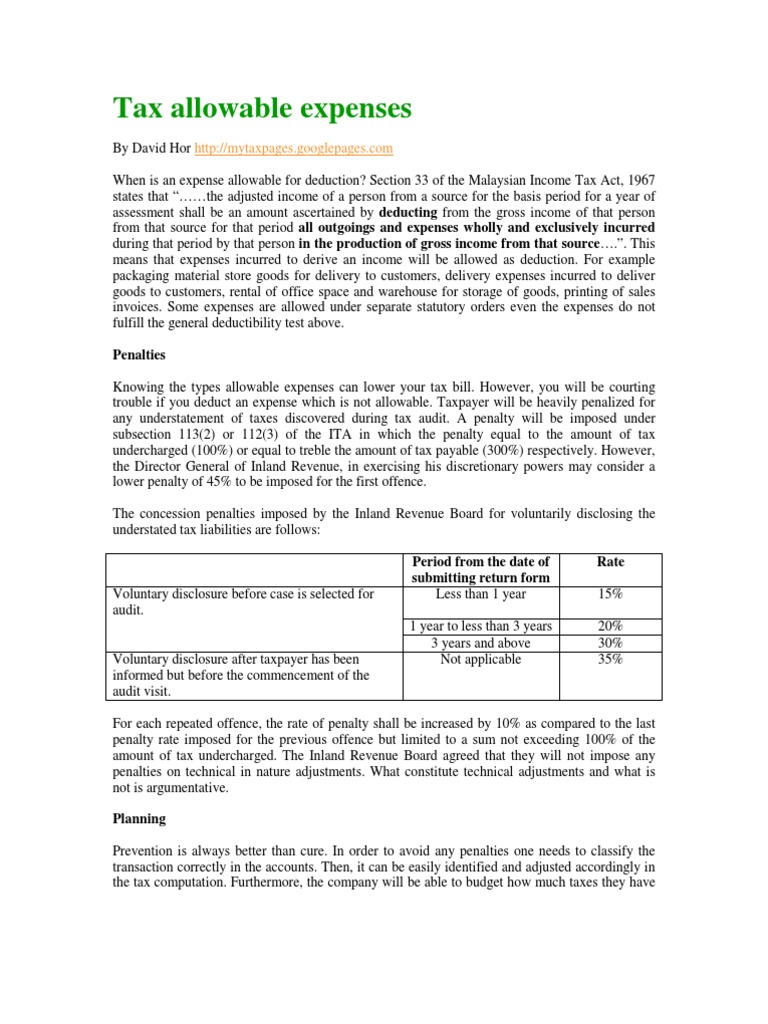

Allowable pre operational pre commencement of business expenses for companies superseded by the public ruling no. Refer to section b5 2 for details of eligible outgoings and expenses. Freight charges incurred for the export of rattan and wood based products from a port airport in malaysia to a port airport outside malaysia. For deductibility of interest expense in a cross border controlled transaction earnings stripping rules may apply.

Epf payment rental of business premise interest on business loan. Where a borrowing is partly used to finance non business operations the proportion of interest expense will be allowed against the non business income. The following are more common non allowable expenses. Share and discuss on malaysian income tax 2017.

Personal expenses example. Pu a 185 2001 y a 1996 5. Expenses incurred in the production of income example. Expenses for repair of premise and vehicles used for business purpose.

Malaysia corporate deductions last reviewed 01 july 2020. Pwc 2016 2017 malaysian tax booklet income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Legal fees are usually allowable and this includes costs of chasing debts defending trademarks preparing legal agreements. Depreciation and loss on disposal capital assets.

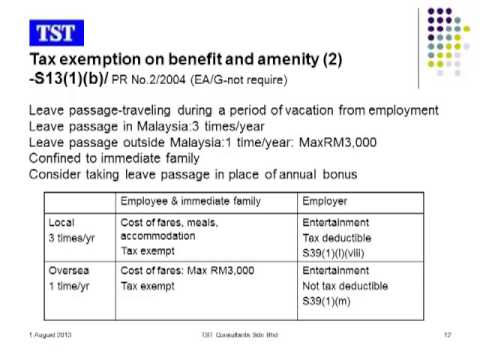

Income attributable to a labuan. Staff entertaining is an allowable expense for company tax purposes whereas client entertaining may be an allowable expense and a portion may be disallowed for company tax purposes. Income tax in malaysia is imposed on income accruing in or derived from malaysia except. The moe will verify the expenses incurred for this purpose.

Examples are costs of obtaining the first tenant for the property advertisement introducer s commission legal fees for preparation of tenancy agreement other expenses incurred prior to the property being rented out renovation and improvement costs. Payment of telephone bills. Expenses that are not incurred. General provision of bad debt.

Legal and professional fees.

.jpg)