Loan Agreement Stamp Duty Delhi

Registration charges tend to be 1 of the property s market value.

Loan agreement stamp duty delhi. The agreement must be filed with mca within 30 days of incorporation. What is a stamp duty. 1 extra duty on the account of each of the local laws is levied for immovable properties if the transfer is covered by the said act a the indian stamp act 1899. We have covered the important things to know about stamp duty in delhi.

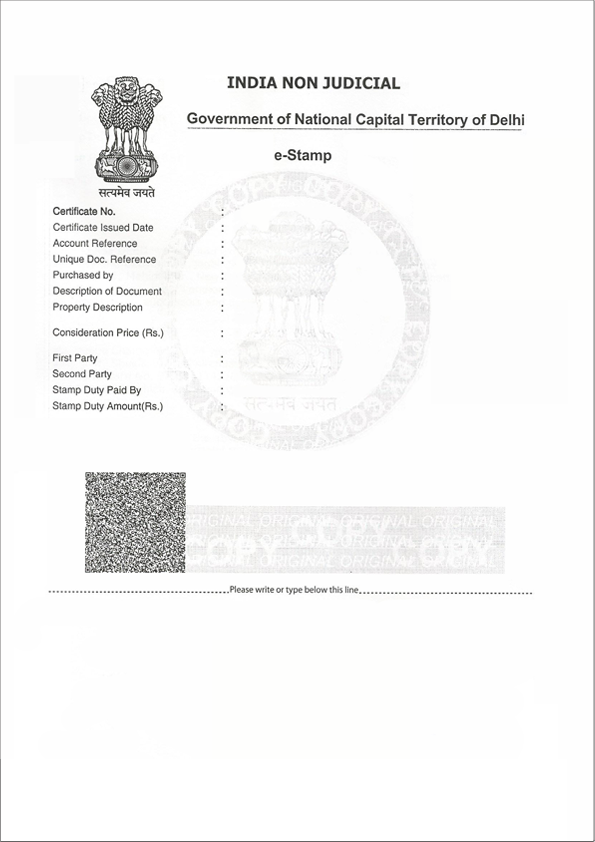

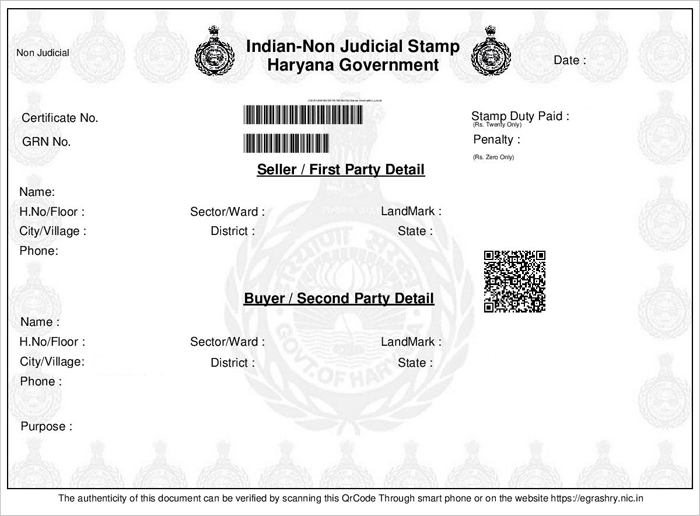

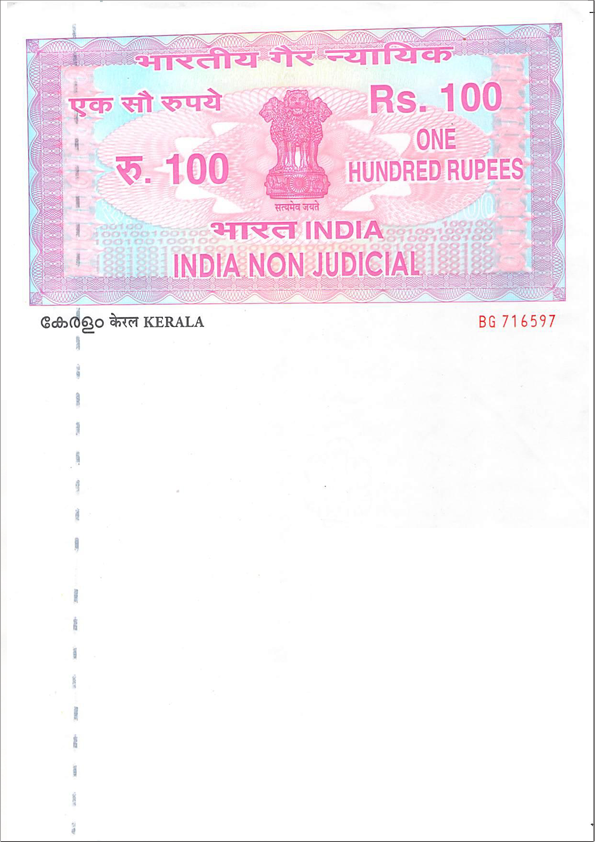

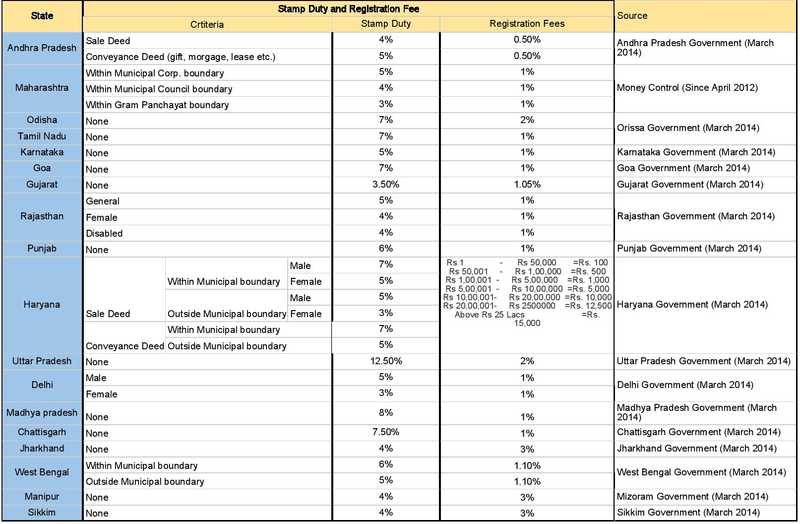

0 1 of the loan securitized or debt assigned with underlying securities if the securities are immovable properties. It can be paid in two ways by purchasing non judicial stamp paper or by franking the agreement from the bank. The duty may be fixed or ad valorem meaning that the tax paid as a stamp duty may be a fixed amount or an amount which varies based on the value of the products services or property on which it is levied. Stamp duty charges by different states of india llp agreement charges for states conclusion.

100 per day for filing an agreement after the due date. The stamp duty and property registration charges in delhi keep changing from time to time. 501 is available in authorized banks for the purpose of purchases. Article 6 of schedule 1a of the delhi stamp act states the stamp duty on the equitable mortgage.

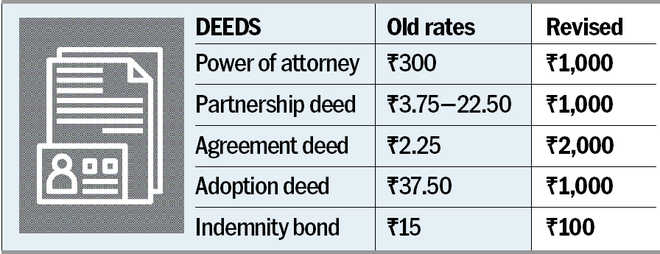

Both property registration charges and stamp duty are based on either of the two following factors. Mca will charge late filing fees of rs. Stamp duty means a tax payable on certain legal documents specified by statute. The stamp duty is 0 5 of the amount secured by the deed if the loan is repayable on demand or more than three months for the date of the instrument evidencing the agreement.

100 stamp duty for indemnity bond bank loan agreement cancellation of gpa and will gaurantee bond etc. In delhi the stamp vendors are authorized to provide stamp paper from rs. 200 stamp duty for partnership deed. The cost of stamp duty is generally 5 7 of the property s market value.

500 and stamp paper of above rs. They serve as one of the largest sources of revenue for the delhi state government. So this is all about the stamp duty. Thus the stamp duty on an llp agreement depends on the state in which it is registered and the amount of capital contribution.